Guide to Selling a House

by Auction

Request a free & no-obligation auction sale price estimate

- Cost effective

No upfront fee & sell for free options - Quick

Sell your home by auction in 28 days - Secure & reliable

Legally binding sale on auction day - Fair & transparent

Sold to the highest bidder

For your peace of mind we are a member of The Property Ombudsman

Selling by auction is quick and easy. Request a no-obligation auction sale estimate for your house or flat.

- ✔ Reliable

- ✔ Fast

- ✔ Secure

Interested to learn more about the easy and efficient process of selling your property by auction?

Talk to our team on 0800 862 0206

Home: Auction Link » Guide to Selling a House at Auction (March 2026)

The marketplace for property auctions has changed dramatically in the last decade. And the range of auction services now available can make the choice a confusing task for property sellers. How do you decide on the type of auction that best suits your requirements?

Why sell by auction?

This guide to selling a house (or flat) by auction is intended to help property sellers decide if auction is a suitable option. And if so, what type of auction best suits their requirements.

Guide to selling a house by auction: Updated by Mark Grantham on 4th March 2026.

Property auctions are quite misunderstood in the UK. For most home sellers, their initial reaction to auction is that it’s “only suitable for run down properties, or desperate sellers”. The truth is that auction offers a secure and efficient method of selling all types of property; giving sellers more control of the sale, compared to an estate agency sale.

Selling a house at auction is a more straightforward process than most people expect. In fact, once sellers understand how it works, many find themselves questioning why anyone would choose the traditional estate agent route at all.

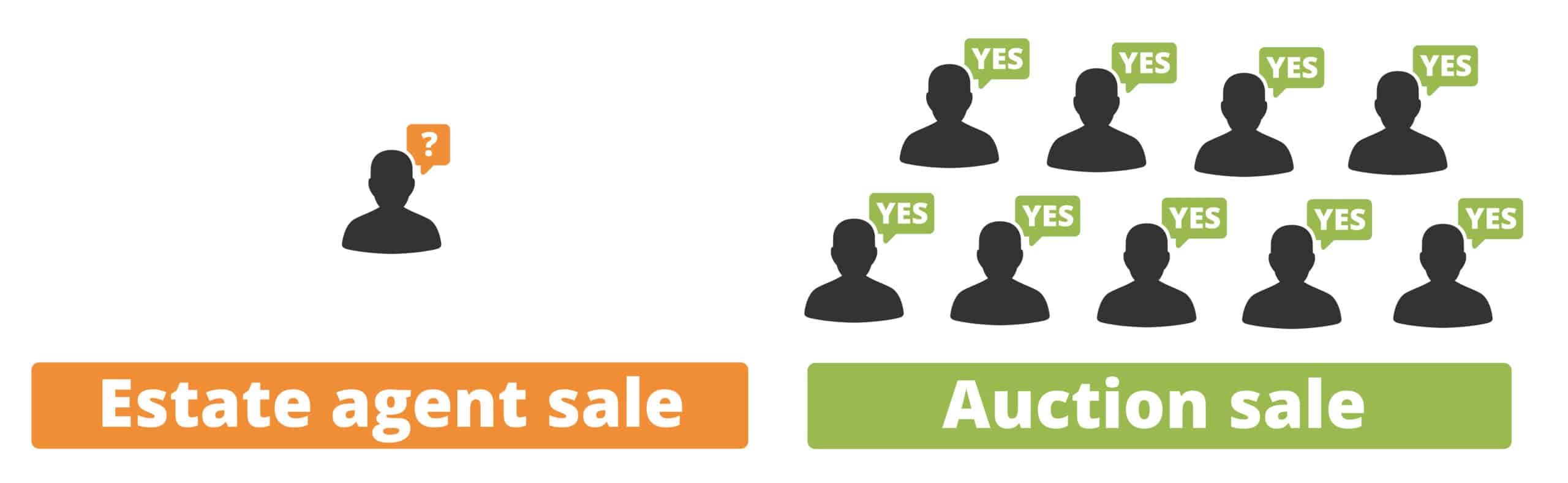

Estate agency sales are prone to false starts; long delays, price drops and fall throughs.

Auction is different. Buyers complete their work and have their finances in place before bidding. Multiple committed buyers compete, and the sale is legally binding on the fall of the hammer.

Estate agency sale

- Only one buyer at a time – the offer is a provisional offer.

- The buyer carries out their research after making their offer.

Auction sale

- Multiple buyers progress at the same time.

- Buyers must complete their research before bidding.

Property auctions have evolved to serve the more “average” property seller. Whilst the “homes under the hammer” style auctions you see on TV are style thriving, there are newer methods of auction designed to suit the requirements of most home sellers.

In this guide:

Types of property auction

Why sell by auction

Disadvantages

7 stage guide

Costs

Choosing an auctioneer

FAQ’s

Why not request a free auction valuation for your property? It only takes a minute! Or feel free to call us on 0800 862 0206 if you have any questions.

Auction sales become legally binding when the hammer falls.

The article is intended as a helpful guide, with general information and tips about selling a house by auction. Please bear in mind, the fees and terms vary by auctioneer, so it’s important that you read and understand the auctioneers terms of business before proceeding with an auction sale. If you’re not sure about anything, we recommend checking with your solicitor. And we’re happy to help if you require general information about selling a property by auction.

Short on time?

If you don’t have the time to read this article in full, we can come back to you with a free auction appraisal, to help you decide if selling by auction is a good option for you. Request a free estimate and we’ll come back to you.

What types of property auction are there?

Whilst the on-the-day “homes under the hammer” style of auctions are still going strong and evolving, there are newer methods of auction designed to suit the requirements of most home sellers.

We broadly categorise the two types of property auction as:

- On-the-day auction

- Extended auction

On-the-day auctions are the type of auction most people are familiar with. The type of auction you might expect to see on television! With 3 to 4 weeks of intensive marketing and a few minutes of bidding on auction day.

- Fixed timescale – bidding takes place on a set date.

- Very quick – 3 or 4 weeks of marketing and 2 to 5 minutes of bidding on auction day.

- Properties are priced to sell very quickly – a significantly below market value reserve price.

On-the-day auctions are live events and are often held in a hotel ballroom or conference room. But are increasingly held online only, where prospective buyers bid by phone or online.

Extended auction

Extended auctions are more like a lengthy auction, with bidding over the course of a month or longer. They can be described as a rolling auction – if your property doesn’t sell at the end of the first month of auction, the auction can be rolled on for a second month.

- Flexible timescale – a rolling auction.

- More time – bids can be placed at anytime over the course of a month, or longer.

- Properties are priced to sell promptly – a below market value reserve price.

Extended auctions are best described as a combination of an estate agency sale and an auction sale. The marketing side of the sale is quite similar to that of an estate agency sale, but the negotiation and transaction side uses the framework of an auction sale – so the property is sold to the highest bidder and the sale is legally binding on the fall of the hammer.

It’s the extended auction that’s really opened up the possibility for more home sellers to use auction, as an alternative to a conventional estate agency sale.

Extended auctions can be further divided into 2 categories: unconditional and conditional.

✔ Unconditional extended auction is legally binding. At the end of the auction, the successful bidder exchanges contracts, following the true rules of auction – the same rules as a traditional, on-the-day auction!

✘ Conditional extended auction is NOT legally binding. The successful bidder doesn’t exchange contracts at the end of the auction, instead they only pay a reservation fee and can back out of their purchase.

Throughout this article, when we talk about selling by extended auction we will be referring to the unconditional type of extended auction, where the sale is legally binding at the end of the auction.

If you’re interested in knowing more, it’s worth reading our guide to the difference between unconditional and conditional auctions.

Need help deciding? If you’re not sure what type of auction service best suits your requirements, please contact us on 0800 862 0206.

Why sell a house by auction?

Auction overcomes many of the inefficiencies of an estate agency sale. If you’ve tried selling with an estate agent, you might be aware the law in England and Wales allows the buyer to reduce their offer at the last minute, or back out of the sale completely. This is explained further on the UK government website (the law is different in Scotland).

The reason estate agency sales fall through is because there’s nothing legally binding about the buyers offer.

The rules of an auction sale are different. Multiple buyers are invited to compete for your property, and the sold sign only goes up once you have exchanged contracts.

- Properties for sale by auction are continually marketed all the way up to exchange of contracts.

- All prospective auction buyers are invited to place their bid. No buyer is turned away.

- Auction buyers have to carry out their research and have funds in place BEFORE they place their bid.

- Competitive bidding from multiple committed buyers.

- Legally binding sale on auction day.

We’ve summarised the 7 key benefits of selling by auction as: a legally binding sale, speed, competitive bidding, reserve price guarantee, intensive marketing, high success rate and transparency. Our guide to the benefits of selling a house by auction explains these key points in more detail. And if you’re selling a flat or apartment, our guide to selling a leasehold flat provides some tips for a successful sale.

With so many benefits, why doesn’t everyone sell by auction? Unfortunately there is no perfect system, and there are a couple of catches to selling by auction; you need to be:

- A chain free seller – be able to move to your next home 4 to 8 weeks after auction day.

- Happy with the auctioneers suggested reserve price.

These two points are explained further in our guide – check these 2 points to see if auction is suitable for you? They are also covered in the next section – the disadvantages of selling a property by auction.

Free Auction Valuation

How much will your property sell for by auction? Request a free valuation and reserve price estimate for your property. In some cases we may need a few more details about your property before providing a free and no-obligation estimate.

There are some disadvantages to selling a property by auction. Although some of the risks can be managed, there are drawbacks that mean some property owners might not feel comfortable selling by auction.

1. Risk of a lower sale price?

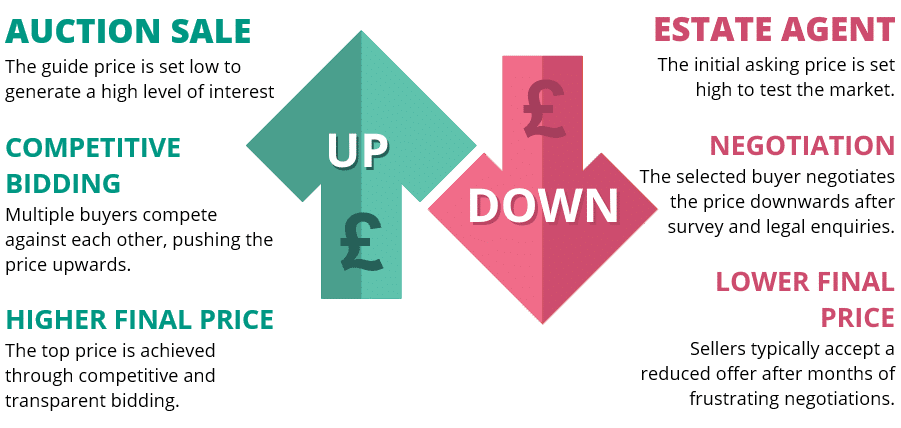

Estate agents talk about “asking prices” and auctioneers talk about “reserve prices”.

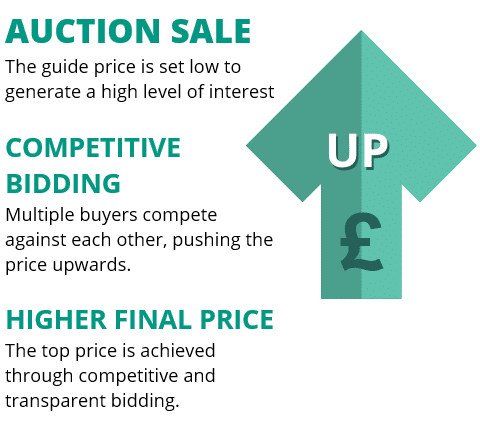

Whilst there’s no upper limit to sale prices at auction, fortunately there is a lower limit – and that’s known as the reserve price.

The reserve price is the lowest amount your property will be allowed to sell for on auction day. It’s your bottom line price or “safety net”. Your property will not be allowed to sell for any less than the agreed reserve price. The final (and highest) sale price is achieved through transparent and competitive bidding, a feature that’s unique to auction sales.

Auction: from Latin augere (“to increase“) especially in the bidding of a property sale.

- The type of property you are selling – some types of property are better suited to an auction sale (particularly the case with an on-the-day auction). The auctioneer will suggest a higher reserve price for properties that are well suited to an auction sale, as discussed later in this article.

- The type of auction – extended auction reserve prices are typically set closer to market value compared to on-the-day auction.

You will need to agree to the auctioneer’s reserve price before booking your property into auction. The reserve price won’t change before auction day, without your consent. It’s important to make sure the reserve price is high enough to cover your outstanding mortgage and other costs associated with moving home.

RISK! An unfortunate outcome would be selling for the reserve price, if you were expecting to sell for more. When bidding reaches or exceeds the reserve price on auction day, contracts are legally exchanged when the hammer strikes. Unlike a private treaty (estate agent) sale where everything is “subject to contract”, at auction the sale is legally binding – sold means sold. The buyer can’t back out of the transaction and neither can the seller.

2. No backing out

To sell your property by auction, you need to be a chain-free seller. In other words, your next home will need to be ready to move in to fairly quickly. Not immediately, but within 4 to 8 weeks after auction day.

The reason you need to be chain-free is because auction sales are legally binding; the buyer cannot back out of their purchase. But likewise, the seller cannot back out of their sale.

If you’re selling a vacant property, that’s ideal. And tenanted properties are fine too, as the tenancy agreement can be transferred to the new owner.

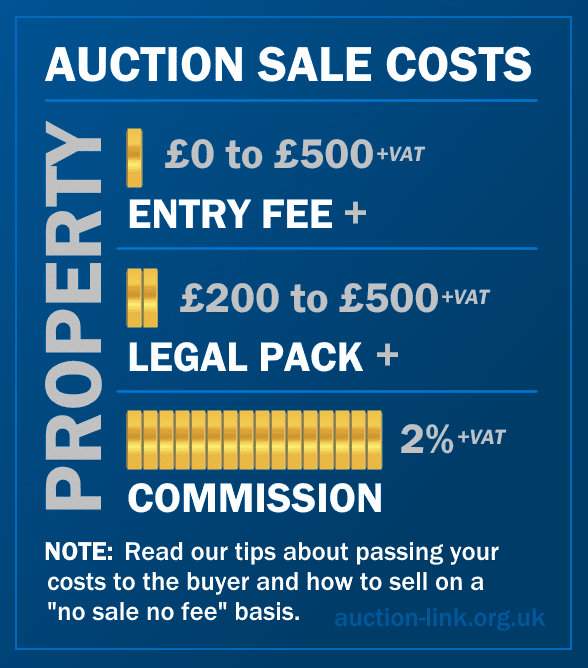

3. Costs more than an estate agent

The costs for selling a property by auction vary; some auctioneers offer a “no sale no fee” service, and some offer to “sell for free”.

Some auctioneers offer a “sell for free” service, with no upfront fees and the commission is paid by the buyer.

On-the-day auction

The overall cost of selling a property at an on-the-day auction is slightly more / comparable to the cost of selling through a traditional high street estate agent. The main cost is the auctioneers commission, which is typically in the region of 2% to 3%+VAT only payable upon successful sale. Some auctioneers also charge an upfront catalogue/entry fee of a few hundred pounds, although it may be possible to postpone payment until after the auction, only payable upon the successful sale of your property.

The cost of preparing a legal pack for auction can vary depending on the complexity of the property, location, and the solicitor (or conveyancer) used. On average, you can expect to pay £200 to £500 – though some providers may charge outside this range depending on the specifics of the property.

Extended auction

The cost of selling at an extended auction is higher, but paid by the buyer. The market rate for selling by extended auction is between 3.5% to 5% + VAT paid by the buyer, along with their deposit on exchange of contracts. The buyer will obviously account for these costs when they bid. But for the seller, the amount you’re offered (the top bid) will be the amount you receive, without any deductions, apart from your solicitors fees.

Some auctioneers offer to prepare the auction legal pack for no upfront cost – only payable when the property successfully sells.

4. Risk of not selling?

Auction is one of the most reliable methods of sale available. Approximately 80%+ of properties that are entered into auction will go on to successfully sell. But still, we’re frequently asked what happens if my property doesn’t sell at auction? It’s one of the the top 5 questions asked by home sellers.

On-the-day auction

If bidding fails to reach the reserve price at an on-the-day auction, the auctioneer will try to secure a sale as soon as possible after the auction. In some cases that might be within a few minutes of bidding ending. If a sale cannot be concluded on auction day, the property will be advertised as “available” and the auctioneer will continue to advertise the property on the portals (e.g. Rightmove and Zoopla) for a period after the auction.

If the property doesn’t sell soon after the auction, the auctioneer will invite you to enter the property into their next auction (most auctioneers will not charge you an additional entry fee for this). Sometimes properties just need a bit more time on the market, so you should stand a better chance of selling next time around.

There is no commission to pay if the property doesn’t sell with the timeframe you have agreed with the auctioneer. But just like most estate agency agreements, if you later sell to a buyer who was introduced by the auction company within their appointed timeframe, you may be liable to paying the auctioneers commission.

Extended auction

The process is different for an extended auction. If bidding doesn’t reach the reserve price by the end of the first auction cycle (a cycle is typically one month), the auctioneer will roll the auction on for a bit longer. There is no loss of momentum from the marketing, the auction end date is simply changed to a future date. The idea is that you sell within the first month or two, but the auction can continue rolling on for longer if needed.

5. Reduced audience of buyers

Who will the likely buyer be? Although there are big incentives for buying though auction; (1) the possibility of buying a property below market value, if the prospective buyer is not outbid (2) a quick purchase and (3) the legal pack provided to the buyer for free. Not every buyer feels comfortable with the speed and definiteness of auction. Some buyers prefer the slower, more cautious process of buying through an estate agent.

That is certainly the case with an on-the-day auction – the audience of buyers are generally the trade end of the market, with only a small proportion being owner-occupier buyers. Extended auctions have a longer bidding period and are considered a more “consumer friendly” auction, the additional bidding time has the effect of broadening the audience of buyers, to include more end-user / owner-occupier buyers, compared to an on-the-day auction.

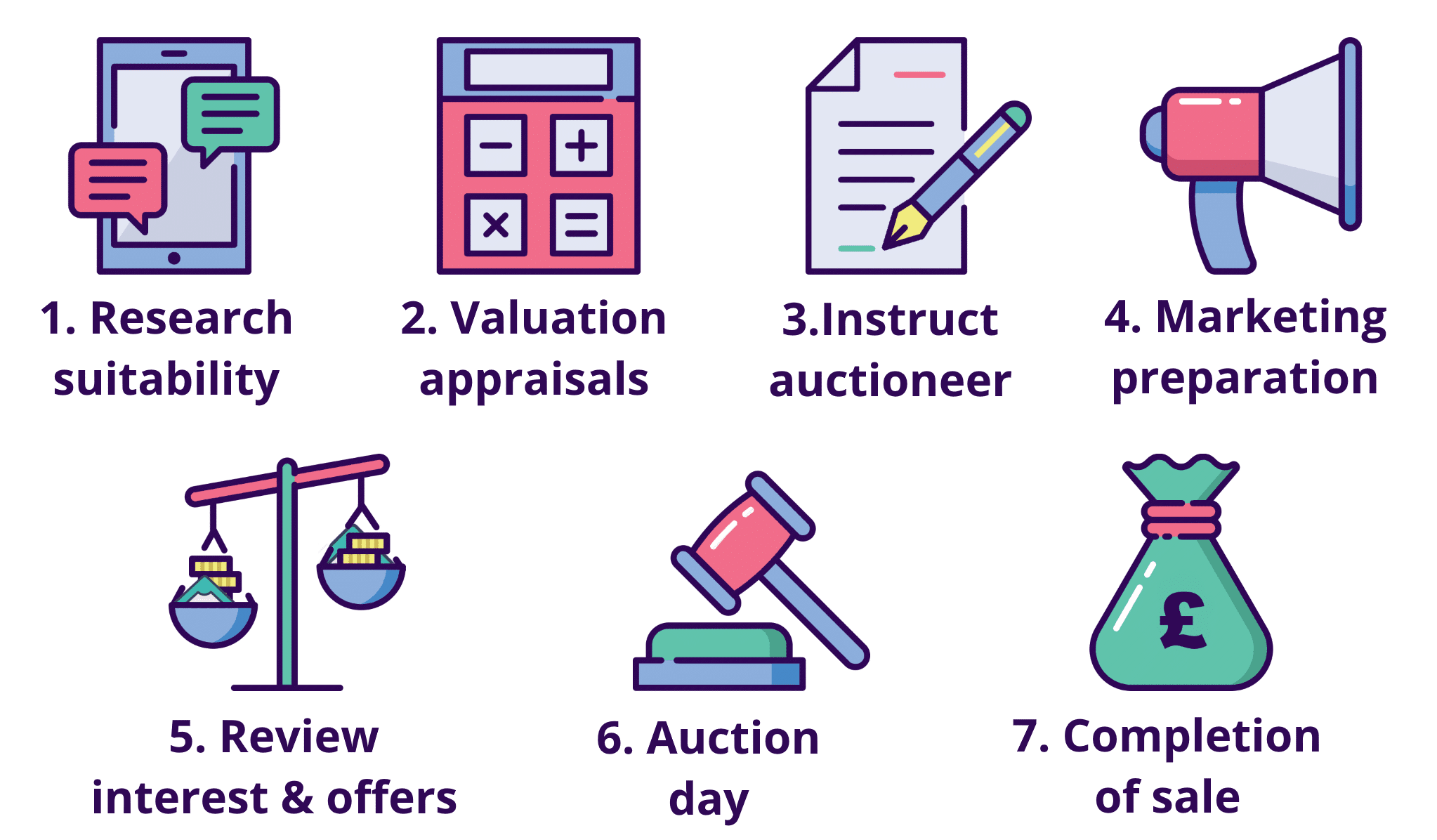

If you’re considering selling your house at auction, the first step is to familiarise yourself with the process and determine whether auction is a suitable option for you. To help you understand the process of selling a property at auction, we’ve provided a step by step 7 stage guide along with an 8 minute video guide to selling a house by auction.

- 1) Research suitability

- 2) Valuation appraisals

- 3) Instruct the auctioneer

- 4) Marketing & preparation

- 5) Review interest & offers

- 6) Auction day

- 7) Completion of sale

Does the speed and definitiveness of an auction sale suit your circumstances, or do you require more flexibility? Think about the price you need to achieve, can you risk selling for the reserve price? There are a range of different auction options available, so it’s worth spending some time considering what type of auction best suits your personal circumstances and property type. Contact us to discuss your options.

There are hundreds of auctioneers in the UK and an increasing range of online auctions to choose from. Ask the auctioneer to appraise your property; they will suggest an auction reserve price (the minimum price your property will be allowed to sell for) and details of their costs. Ask the auctioneer to provide you with examples of recent sales for properties similar to yours. Find out what price those example properties actually sold for at auction.

Contact us for a FREE auction appraisal.

Once you have narrowed down your choice of auctioneers, consider the timescales you need to work to. You will usually need to book into auction 3 to 4 weeks before auction day. Booking into auction is easy, you will just need to sign and return the auctioneers terms of business. You will need to find a solicitor to help with the sale.

There are 2 areas of preparation before auction day. Firstly your solicitor will need to prepare the auction legal pack; you will need to respond promptly to any forms they ask you to complete. Secondly the auctioneer will carry out the marketing, which includes advertising the property and conducting viewings.

The auctioneer will provide you with feedback on the level of interest to help you make a decision on whether to accept an offer before auction day e.g. number of viewings, number of legal packs downloaded and number of buyers registered to bid (including telephone bidders and proxy bidders). In most cases it’s best to allow prospective buyers to compete for a property in the room – that’s how you can be sure of achieving the top price. However, if your circumstances mean that you have a strong preference of securing a sale before auction day, you will have that option.

On auction day buyers will compete to purchase your property – the only way a buyer can secure your property is to be the highest bidder. Bidding for each auction lot usually lasts about 2 or 3 minutes. When bidding meets or exceeds the reserve price you know you have sold! On auction day the winning bidder exchanges contracts and pays a 10% deposit, for completion of sale 28 days later. You don’t need to attend the auction, neither does your solicitor, but it can be an exciting experience and worth doing if you are able to.

In the days or weeks after the auction solicitors will finalise the transaction. Completion usually takes place 28 after but can be sooner if the buyer and seller are happy to do so. You will need to make sure you have moved out of the property and are ready to hand over the keys on completion day. Your solicitor will receive full completion funds from the buyer and transfer the proceeds of sale to your bank account.

Video Guide: Selling a House by Auction

We’ll also explain the pros and cons of selling at auction, give tips on how to maximise interest in your property, and what to expect on auction day itself.

Auction is suitable for most types of property, but it doesn’t suit everyone’s circumstances. To sell by auction you need to be a chain-free seller and happy with the auctioneers suggested reserve price.

- Are you a chain-free seller? If you’re selling at auction, you’ll need to be ready to move quickly – completion usually takes place within 4 to 8 weeks after the auction date. That’s because the completion date is set in advance and is legally binding for both buyer and seller. If you’re not currently living in the property, there’s a good chance you’re chain-free. This is definitely the case if the property is vacant. Even if the property is tenanted under an Assured Shorthold Tenancy (AST), you’re still likely to be considered chain-free, as the tenancy can typically be transferred to the new owner.

- Happy with the reserve price? The reserve price is the minimum amount your property can sell for at auction. It’s usually set below market value to encourage competitive bidding and drive the final sale price higher. However, if you’re not comfortable with the reserve price suggested by the auctioneer, selling at auction may not be the right option – there’s always a chance the property could sell for no more than the reserve on the day.

If you’re not sure if you meet these two important pre-requisites for selling at auction, check out our selling by auction 2 initial checks page.

Reserve prices and timescales differ between on-the-day and extended auctions.

Typically, reserve prices are higher (closer to market value) in extended auctions. This is because the longer timeframe allows for more extensive marketing and gives more buyers the opportunity to bid. Unlike on-the-day auctions, where bidding happens in a short window on a single day, extended auctions run over several weeks, allowing prospective buyers to place bids at any time during that period.

Valuations are based on comparable sales in the local area. This involves looking at the sale prices of similar properties nearby, then adjusting for any differences between those properties and yours. It’s also important to factor in current market conditions – for example, whether property prices have risen or fallen since those comparable homes were sold.

Estate agents, auctioneers, and surveyors determine property values by looking at comparable recent sales in the area.

Most sellers have a general idea of what their property is worth. However, valuing a property isn’t always straightforward – especially if the home is unique and there are no recent comparable sales nearby. It can also be challenging when a property is in poor condition, as the cost a buyer would need to spend to make it habitable must be taken into account.

Will someone need to visit my property to provide a valuation?

Auctioneers tend to work differently from estate agents, so it’s useful to understand why estate agents usually carry out in-person visits. These visits aren’t just about assessing the value or suggesting an asking price – they also give the agent a chance to build a relationship with the seller and earn their trust.

When selling through an estate agent, it’s common for them to view the property in person before advising on an asking price.

Estate agents may occasionally recommend an inflated asking price in order to secure the seller’s instruction.

Unless you’ve specifically asked an estate agent for a realistic market valuation, the asking price they suggest is often set higher than the property’s actual value. In many cases, that’s perfectly reasonable – testing the market with a higher price can sometimes be a sensible strategy.

However, sellers should be aware that some agents may suggest an overly high asking price simply to win the instruction. It’s also important to keep in mind that both asking prices and initial offers can change, typically downward, before contracts are exchanged.

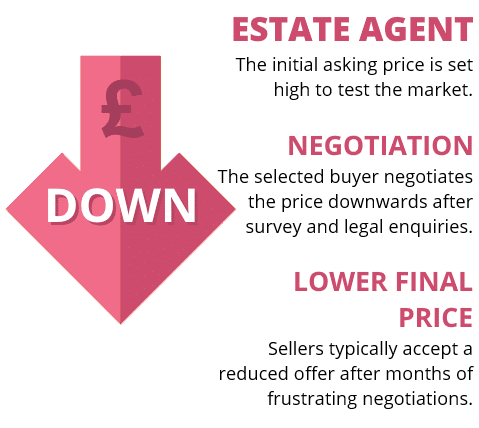

Auction sales are different from private treaty (estate agency) sales. Negotiation is in the opposite direction!

An auctioneer may sometimes visit a property before discussing pricing, but it’s not always necessary. In many cases, they’ll be happy to provide a desktop valuation – relying on the information you provide, along with market data, rather than conducting an in-person visit. This is because auction pricing works quite differently from a traditional private treaty (estate agency) sale. It’s best summed up by the saying: “A property is worth what the market is willing to pay.”

When you set a value or asking price and then accept an offer near that figure, it’s similar to an estate agent “putting a lid” on the price. Auctions, however, operate differently – there’s no ceiling. The final sale price is driven purely by market demand. Ultimately, a property is worth what buyers are willing to pay, not what an estate agent thinks it’s worth.

In an auction sale, a property’s value is determined by open market competition. It’s not based on the opinions of estate agents or surveyors, but rather decided by buyers themselves – through a transparent and competitive bidding process.

Properties achieve their highest price at auction through the momentum of competitive bidding.

Auctioneers take a different approach to pricing compared to estate agents.

They’re not in the business of quoting flattering asking prices just to secure your instruction. If you enquire about selling your home at auction, you’ll likely notice that auctioneers are typically more direct and less focused on offering overly optimistic valuations to please the seller.

When advising on how to price your property for auction, an auctioneer will consider two key factors. The property needs to be:

-

Priced competitively to stand out against other properties in the area and attract strong interest from potential buyers. The logic is simple: the more bidders competing, the higher the final sale price is likely to be.

-

Priced for a timely sale. Auctioneers work to fixed timescales and have limited capacity. If a property is priced too high and fails to generate sufficient interest or sell on auction day, it represents lost time and effort – resources that could have been used to sell another property.

Free Auction Valuation

Auctioneers will not just tell you want you want to hear about price. They need to price the property to sell. Request a free valuation and reserve price estimate for your property.

While auctioneers don’t set an “asking price” or cap a property’s value, they do establish a minimum sale figure – known as the reserve price. This is the lowest amount the property can legally be sold for at auction.

What is a reserve price?

There’s no upper limit to what a property can sell for at auction – but there is a lower limit, known as the reserve price.

When selling at auction, you can be confident that your property won’t be sold for less than this agreed minimum. The reserve price is set in advance, in agreement between you and the auctioneer before the property is entered into the auction catalogue.

Reserve prices are typically set below market value to encourage competitive bidding. If the figure proposed by the auctioneer is too low for you, there may be some room for negotiation – but don’t expect it to move significantly higher.

Once agreed, the reserve price cannot be reduced without the seller’s consent.

Find out more about auction reserve prices and why they’re so important!

Choosing an auctioneer

Property sellers often ask whether they should go with the auctioneer who suggests the highest reserve price. There’s no simple yes or no answer – but making your decision based solely on the reserve price is generally not advisable.

TIP If an auction company proposes an unrealistically high reserve price and also asks for an upfront fee to list your property, it’s wise to proceed with caution. Avoid paying fees unless there’s a genuine and realistic chance of selling your property.

A better way to frame the question might be this: if a reputable auctioneer – with a strong track record, high success rate, and proven experience selling similar properties in your area recommends a lower reserve price than another auctioneer who can’t provide recent, relevant examples, which one would you trust with the sale?

A reputable auctioneer won’t want to invest time and resources into marketing a property that’s overpriced.

It’s also important to consider the type of auction service being provided. A higher reserve price may be justified if the service includes wider marketing exposure, stronger support for prospective buyers, or a more advanced bidding platform.

What type of auction service is best for you?

Request a free valuation and reserve price estimate for your property today. In some cases we may need a few more details about your property before providing a free and no-obligation auction sale estimate.

If you’re currently researching different auctioneers, it’s a good idea to ask each one for a breakdown of their fees and a copy of their terms of business. As with any service, it’s best to get this information in writing – ideally by email – rather than relying solely on verbal conversations. If you’re speaking with multiple auctioneers, you can then weigh up their suggested reserve prices and costs as part of your overall decision-making process.

The section how to choose an auction company will give you some more points to consider.

Property sellers often ask whether they can change their mind after the auction. So before we explain how to enter your property into auction, it’s important to understand the key risk involved: once the hammer falls, the sale is legally binding.

If you’re not absolutely certain you want to sell, then an auction may not be the right route. Once bidding reaches or exceeds the reserve price, the sale is final – you cannot back out.

RISK! You’re free to speak with an auctioneer and discuss a potential reserve price without any obligation. However, you should not formally instruct an auctioneer unless you are fully committed to selling your property.

Once you’ve made the decision to sell at auction and chosen your preferred auctioneer, these are the five key steps to getting your property listed:

- Notify your estate agent if you’ve previously instructed one.

- Make arrangements to vacate the property by the agreed completion date.

- Supply proof of ID to the auctioneer.

- Review, sign, and return the auctioneer’s terms of business.

- Instruct a solicitor to handle the legal work.

Serve notice to your estate agent

This section applies only if you’ve already appointed an estate agent to sell your property.

Auctioneers typically require exclusive rights to market your property. This means they don’t want any other estate agent (or another auctioneer) advertising the property in the lead-up to auction day. This isn’t about taking business from a competing agent, but rather ensuring their own sales and marketing efforts are as effective as possible. Auctioneers aim to direct all buyer interest through the auction process.

If both an estate agent and an auctioneer are marketing the property at the same time – such as through separate listings on Rightmove – it can cause confusion for potential buyers. Worse still, a competing estate agent might discourage buyers from bidding at auction, hoping to be re-instructed by the seller at a later stage.

Even if you’ve already served notice to your estate agent, it’s essential to check the terms of your agreement. If the notice period hasn’t expired before auction day, you could be liable for commission to both the estate agent and the auctioneer.

See our guide on how to properly serve notice to your estate agent.

An exception to this rule: Some auctioneers (typically for extended auctions) work in partnership with local estate agents. In these cases, the auctioneer may appoint a local agent to assist with marketing, handle viewings, and tap into their own buyer database. These partner agents are selected by the auctioneer (not the seller) and are trained to work within the auction process.

Be prepared to move out of your property

When selling your property at auction, the two key dates to keep in mind are the exchange date and the completion date. The completion date is when ownership transfers to the buyer, the keys are handed over, and you must vacate the property.

- Exchange Date – When the hammer falls on auction day, your property is officially sold and contracts are legally exchanged. You can continue living in the property for a short period, but should have clear plans to move out by the completion date – typically around four weeks after exchange.

- Completion Date – By this date, you must have fully vacated the property. The keys will be handed over to the new owner – either by you, your solicitor, or the auctioneer. After completion, you will no longer have access to the property, so all personal belongings must be removed in advance unless alternative arrangements have been agreed with the buyer.

When listing your property for auction, your solicitor will confirm the exact completion date. If your circumstances change, you can ask your solicitor to request a revised completion date – such as a two-week extension – but this must be done before the auction takes place. Once contracts are exchanged (when the gavel falls), the completion date is legally binding and cannot be changed.

There’s a common misconception that sellers must vacate the property immediately after the auction. This isn’t the case. Just like with an estate agency sale, there is a set period between exchange and completion, giving you time to make firm arrangements to leave the property and move into your next home.

If you’re selling a tenanted property and the tenant will remain in place, the tenancy agreement will transfer to the new owner. You’ll stop receiving rent from the day of completion, and from that point on, you’ll no longer be responsible for the property or any obligations under the tenancy.

Find out more about selling a tenanted property by auction

There are a few additional tasks to prepare for completion day, such as notifying the local council and utility providers that you no longer own the property. For more information, see Section 7: Completion Day.

Instruct a solicitor

Although it’s not essential to have instructed a solicitor before entering your property into auction, it’s advisable to find one early and inform them of your intention to sell – ideally before formally instructing the auctioneer. Letting your solicitor know the auction date in advance helps ensure they have enough time to prepare the legal pack.

If the legal pack is delayed or incomplete, prospective buyers may not have enough time to review it properly, which could affect interest or even prevent a sale.

Most conveyancing solicitors are happy to handle auction sales, so if you already have a solicitor, it’s worth checking if they can assist. Alternatively, auction companies can usually recommend solicitors who are experienced with auction transactions.

Provide proof of identification

Just like when selling through an estate agent, an auctioneer will require up-to-date identification from the legal owner(s) of the property. This is to confirm two key points: (1) your identity, and (2) your legal ownership of the property.

Auctioneers are legally obliged to carry out anti-money laundering (AML) and know your customer (KYC) checks, and cannot proceed with your instruction until valid ID has been provided.

You’ll need to supply photographic ID (such as a passport or driving licence), along with a recent document from a recognised organisation – like HMRC, a bank, or a utility provider. If you’re not living at the property you’re selling, these documents must reflect your current residential address.

Many auctioneers now carry out ID checks using online verification platforms (such as Credas). These services typically require you to download an app, follow step-by-step instructions, and submit both a photo of your ID and a selfie for facial recognition.

The auctioneer will also verify that the name on your ID matches the name listed on the Land Registry title.

If the property has multiple owners, each co-owner will need to provide their own proof of identity. And if you’re selling a probate property, you’ll also need to provide the grant of probate (or letters of administration) before proceeding.

Sign and return the auctioneers terms of business

The auctioneer’s terms of business (also known as the agency agreement) will cover many of the same points typically found in an estate agent’s contract. It’s important to review this document carefully, with close attention to the following:

- Fees and charges

- Length of the exclusivity period

- Agreed reserve price

- Terms for cancellation or withdrawal

- Scheduled auction date

When reviewing the auctioneer’s terms, consider what your obligations will be in the following scenarios:

- What happens if the property doesn’t sell on auction day?

- What if the legal pack isn’t ready in time for the auction?

- What are the implications if you need to withdraw the property before auction day?

Don’t feel pressured to return the auctioneer’s terms of business immediately. It’s perfectly reasonable to take a day or two to review them carefully – or even ask a friend for a second opinion. You may also find helpful advice in the section How to Choose an Auction Company before making your final decision.

You’ll need to confirm your auction entry at least four weeks before auction day. Most auctioneers publish their auction calendar, including the entry deadlines for each date. This four-week window gives the auctioneer enough time to market the property effectively, arrange several open house viewings, and allows your solicitor to prepare the auction legal pack in good time.

Preparation is essential for a successful auction sale. In addition to marketing the property to the widest possible pool of buyers, all prospective bidders must be able to carry out their due diligence in advance – since the sale becomes legally binding on auction day.

It’s the responsibility of the auctioneer, the seller, and their solicitor to ensure that all relevant information is made available to buyers before they place a bid. This preparation falls into three main areas:

1. Marketing – A detailed description of the property, accompanied by photos and often a floor plan or video tour. These marketing particulars appear on the auctioneer’s website and property portals such as Rightmove and Zoopla.

2. Viewings – The auctioneer will organise access for potential buyers to view and inspect the property ahead of auction day.

3. Legal Pack – This includes essential legal documents such as the Land Registry title, searches, and property information forms. Prospective buyers and their solicitors can review these before the auction to inform their decision.

These 3 key parts of preparing for an auction sale are explained in more detail:

Marketing

Reaching the widest possible audience of buyers is key to a successful auction sale. Auctioneers use a range of marketing methods to maximise exposure and attract serious interest from prospective buyers. A central part of this strategy involves advertising the property at an appealing price point.

The first step in preparing the marketing materials is for the auctioneer to arrange professional photographs and write a property description. You, as the seller, will be asked to approve this description before the listing goes live. As auction marketing typically runs for just 3 to 4 weeks before auction day, it’s important to avoid delays – promotion can only begin once the details have been signed off.

Once approved, the property will be widely advertised:

- On major property portals such as Rightmove and Zoopla

- In the auctioneer’s catalogue

- Through email campaigns or mailshots to their buyer database

You’ll also be asked whether you’d like a “for sale” board placed outside the property – this is optional, depending on your preference.

How Auction Marketing Differs from Estate Agency Marketing

1. Attractive guide price

Unlike the reserve price, the guide price is a marketing tool. It’s typically set below the reserve to generate maximum interest (e.g. a reserve of £300,000 might have a guide price of £270,000). A lower guide price encourages more buyer enquiries and increases competition. Read our article on guide prices for more insight into this strategy.

2. Quick and intensive campaign

With auctions, the first week or two of marketing is critical. Buyer interest tends to peak early, so auctioneers focus their efforts on making an immediate impact – especially when the auction catalogue is first released. Alongside standard marketing channels (portals, signage, etc.), the urgency of a set auction date helps build momentum and excitement among buyers.

In the lead-up to auction day, auctioneers follow up actively with interested buyers – reminding them of viewing dates and encouraging them to register to bid.

3. Concise property descriptions

Auction listings, such as those on Rightmove, tend to feature shorter descriptions compared to estate agency listings. While auctioneers may include floorplans or video tours, they rarely go into detailed descriptions of room sizes, aspects, or features. For example, where an estate agent might describe a kitchen in several lines, an auctioneer may summarise it in a single sentence.

That said, the total amount of available information is often greater in an auction sale. This is thanks to the auction legal pack, which provides buyers with a comprehensive overview of the property from a legal perspective – covered in detail in a later section.

Do you need to disclose property defects?

Yes – when selling at auction, any known defects that could materially affect the property’s value must be disclosed to prospective buyers. This is especially important if the issue isn’t immediately visible.

Viewings

Viewings are a vital part of the auction process, giving prospective buyers the opportunity to inspect the property before deciding to bid. Sellers are usually required to provide a set of keys to the auctioneer, allowing a representative to access the property and conduct viewings. There’s no need for the seller to be present during these appointments – unless they choose to be.

The viewing process varies depending on the type of auction: on-the-day or extended.

On-the-day auction

1. Scheduled Open Days

Traditional, on-the-day auctioneers often organise fixed open viewing days, where several potential buyers can attend at the same time. These dates are typically advertised in the auction catalogue, online listings, or via email to registered buyers.

2. Third-Party Viewings

Auctioneers frequently outsource viewings to professional viewing companies. These specialists manage access, coordinate schedules, and oversee the viewings, especially useful when the auctioneer is handling multiple properties.

3. Limited Access

Due to the fast-paced nature of on-the-day auctions, viewing opportunities are limited – often just three or four slots before auction day. It’s important for interested buyers to act quickly.

Extended auction

For extended auctions, the viewing process may follow a similar structure to on-the-day auctions or resemble a more flexible estate agency-style approach.

1. Flexible Appointments

Extended auctions often allow for greater flexibility, with prospective buyers able to book viewings at times that suit their schedule – much like a standard private treaty sale.

2. Managed by Estate Agents

In many extended auctions, viewings are handled by a local estate agent working in partnership with the auctioneer. This often results in a more personalised experience for buyers.

3. Longer Viewing Period

Because extended auctions run over several weeks, buyers have more time to arrange a viewing – helping to generate more interest and encouraging well-informed bidding.

Traditional on-the-day auction viewings are usually fixed and structured for efficiency, whereas extended auction viewings are more flexible and tailored to the buyer’s convenience – closely resembling the viewing process of a typical estate agency sale.

Auction Legal Pack

Alongside marketing and viewings, the third essential element in preparing for a successful auction sale is the legal pack. A property cannot be sold at auction without one – and if the legal pack is incomplete, buyers may lack the confidence to bid, which can ultimately impact the final sale price.

The auction legal pack includes much of the same information a buyer would receive when purchasing through an estate agent. However, rather than being drip-fed over the course of several months during the conveyancing process, all documentation is made available upfront, giving buyers the opportunity to review everything before placing a bid.

Auction buyers are considered to have read and understood the contents of the legal pack prior to bidding – since the sale becomes legally binding the moment the hammer falls.

Read our full guide to learn more about legal packs when selling your property at auction.

In the weeks leading up to auction day, the auctioneer will keep you informed about the level of interest in your property. A final update is typically provided a day or two before the auction.

They’ll usually share the following key indicators:

- Total number of property viewings

- Number of legal pack downloads or requests

- Count of registered bidders

- Any proxy or absentee bids*

- Pre-auction offers received

*What is a proxy bid? Also known as maximum bidding, a proxy bid is when a prospective buyer informs the auctioneer of the highest amount they’re willing to pay. The auctioneer then bids on their behalf during the auction, up to that maximum limit. This option is often used by buyers who are unable to participate in the live auction.

The feedback provided by the auctioneer isn’t just a routine update – it also gives the auctioneer a chance to offer strategic recommendations to the seller ahead of auction day, if needed.

These recommendations may vary depending on whether the sale is through an on-the-day (traditional) auction or an extended auction format.

On-the-day auction

In a traditional on-the-day auction, the auctioneer will typically suggest one of the following four courses of action before auction day:

1. Proceed with auction at the agreed reserve price

If there has been strong interest in the property, the auctioneer may advise sticking with the agreed reserve price, confident that competitive bidding will result in a sale at or above that level.

2. Accept an offer prior to auction

In some cases, a sale can be agreed before the auction takes place. If you choose to accept a pre-auction offer, the auctioneer will arrange for contracts to be exchanged before auction day, and the property will be withdrawn from the auction. It will then be listed as “sold prior to auction.”

A property might be sold prior to auction in the following 2 circumstances:

a. If the auctioneer receives an offer before auction day that exceeds the reserve price, they will present it to you for consideration. Based on additional feedback – such as the number of likely bidders on the day – the auctioneer may advise that bidding may not reach this pre-auction offer level. You can then decide whether to accept the offer ahead of the auction.

In situations like this, sellers often ask whether they can raise the reserve price before auction day.

b. If a pre-auction offer has been made below the reserve price and overall interest in the property has been limited, the auctioneer may advise you to weigh up your options: either accept the offer in advance, or proceed to auction and risk the property not selling. There’s a possibility that the buyer who made the offer – or any other potential bidder – may not be willing to meet the reserve on the day.

3. Reduce the reserve price

To help secure a successful sale on auction day, the auctioneer may recommend lowering the reserve price. For example, if there is only one registered bidder showing serious interest, the auctioneer will assess their feedback and try to gauge the level they are likely to bid. If it becomes clear that the bidder is unlikely to meet the current reserve, the auctioneer may ask the seller to reconsider the reserve price.

Important: The seller is under no obligation to reduce the reserve – this figure will have been agreed in advance with the auctioneer.

This kind of decision can be difficult, as the following example illustrates:

Suppose the reserve price is £300,000 and there’s just one registered bidder, who has told the auctioneer they’re definitely planning to bid but won’t go higher than £290,000. The seller decides to hold firm and keep the reserve at £300,000.

On auction day, the auctioneer may place what are known as “off-the-wall” bids – also called “phantom” bids – up to just below the reserve, to try and encourage the bidder to increase their offer. This practice is permitted in auctions. For example, the auctioneer might bid up to £299,000, hoping the real bidder will jump to £300,000, allowing the property to be sold with the fall of the hammer.

However, if the bidder doesn’t raise their bid, the property will be declared unsold and marked as available for offers after the auction.

After the auction, the seller may decide to accept the £290,000 offer – but by then, the momentum may have been lost. The prospective buyer could feel they’re in a stronger negotiating position and may submit a lower offer, or walk away entirely.

4. Postpone the sale to a future auction (withdraw from the current auction)

An auctioneer may recommend withdrawing a property from the auction for one of the following reasons:

a. The property isn’t ready for sale.

If the legal pack is incomplete or has been delivered too late to give buyers adequate time to review it, the auctioneer may advise withdrawing the property and re-listing it in a future auction once everything is in place.

b. Very low interest or no registered bidders.

If there has been minimal interest in the property, or no registered bidders at all, the auctioneer might recommend withdrawing it rather than allowing it to be marked as “unsold” on auction day. In such cases, the property may simply need more time on the market, and the auctioneer may suggest relisting it in a future auction with a fresh marketing push.

Can the reserve price be increased before auction day?

It’s rare for an auctioneer to agree to a higher reserve price ahead of auction day. Raising the reserve can reduce the likelihood of a successful sale, which in turn risks the auctioneer missing out on their commission. That said, there are some exceptions.

Most auctioneers include a clause in their terms and conditions stating that if the seller chooses to raise the reserve and the property doesn’t sell, the seller may still be liable for a fee – often equal to the full commission that would have been earned if the sale had gone through.

Auctioneers aim to achieve the best possible result for the seller. In cases where there’s exceptionally strong interest and the auctioneer is confident bidding will far exceed the original reserve, they may agree to increase it (without the seller being liable to pay a fee if the property fails to sell). This can act as a safeguard: if unforeseen news (such as a sudden economic shock or recession announcement) dampens buyer confidence on auction day, a higher reserve can help ensure the property isn’t sold significantly below its value to a lone bidder.

We have now covered the four possible recommendations a traditional on-the-day auctioneer might make before auction day. Let’s now turn to the six recommendations typically made in an extended auction.

Extended auction

Before outlining the recommendations an extended auctioneer might make, it’s helpful to remember that the bidding process in an extended auction is quite different from an on-the-day auction. Instead of a few minutes of fast-paced bidding on a single day, extended auctions run continuously, allowing buyers to place bids at any time over a typical period of one month.

Just a reminder: this article refers specifically to the unconditional type of extended auction, where the sale becomes legally binding the moment the hammer falls.

Most extended auctioneers offer sellers private access to an online portal where they can track interest in real time. This typically includes key metrics such as the number of property views, the number of bids placed, the current highest bid, and comments or notes from prospective buyers – such as whether they’re seriously considering a bid. In addition to the portal, a good auctioneer will maintain regular contact with the seller by phone throughout the auction period.

Because extended auctions run over a longer timeframe, the advice and recommendations from the auctioneer often differ slightly from those given in a traditional on-the-day auction.

Here are six common recommendations an extended auctioneer may make:

1. Proceed at the agreed reserve price

If there is strong interest in the property, there’s usually no need to make changes. The auction can continue as planned with the original reserve price.

2. End the auction early with a short run-off period

If bidding activity is high – particularly within the first week or two – and the reserve price has already been exceeded, the auctioneer may suggest ending the auction early to capitalise on momentum.

If the seller agrees, the auctioneer will notify all interested parties of the new closing date and apply a short run-off period (typically 2 hours to a few days) to allow final bids.

That said, sellers may prefer to let the auction run its full course, which is often advisable. However, in uncertain market conditions – such as during periods of economic instability – it may be worth considering an early close to secure a strong price before buyer sentiment shifts.

3. Accept a “today only” offer

Occasionally, a buyer – often a professional investor – may submit a bid valid for that day only. These offers are usually made in the hope of securing a quick deal at a lower price.

We don’t typically recommend accepting such bids unless the offer is sensible and the seller places high value on an immediate exchange of contracts. If you’re considering accepting, ask the auctioneer to initiate a brief run-off period (e.g. 2–3 hours) to see if any other bidders step in before the end of the day.

4. Reduce the reserve price

One of the benefits of an extended auction is the flexibility to adjust the reserve price during the bidding period. If, in the final hours – or even at the close of the auction – the top bid falls short of the reserve, the auctioneer will notify the seller. At that point, the seller has a choice:

a. Reduce the reserve to match the top bid and complete the sale with an immediate exchange of contracts.

b. Maintain the original reserve and allow the auction to continue beyond the scheduled end date to generate further interest.

Adjusting the Reserve Price to Secure a Sale

In a traditional on-the-day auction, the reserve price acts as a firm minimum. If bidding doesn’t meet or exceed that threshold during the live auction, the property is typically marked as unsold. While post-auction negotiations may follow, no sale can take place unless new terms are agreed afterward.

In contrast, extended auctions offer greater flexibility. With the seller’s approval, the auctioneer can accept the highest bid (even if it falls below the original reserve) allowing contracts to be exchanged on auction day. This adaptability can help speed up the sale process and avoid the uncertainty of waiting for further offers.

However, this approach relies on open communication between seller and auctioneer. Sellers must be willing to consider adjusting their expectations based on real-time bidding activity. For many, this flexibility increases the likelihood of achieving a timely and successful sale.

5. Extend the auction duration

One of the key advantages of an extended auction is the flexibility to adjust the end date. If bidding does not reach the reserve price by the scheduled closing date, the auctioneer can extend the auction – sometimes by two weeks, four weeks, or longer if needed – until the reserve is met. This approach allows for more time to attract additional interest and secure a successful sale with an exchange of contracts, without having to mark the property as unsold or withdraw it entirely.

6. Withdraw the property from auction

If bidding does not reach the reserve price in an extended auction, even if the auction rolls on for a second motnh, the seller may choose to withdraw the property from the auction. This requires formal notice to the auctioneer. The notice period is typically 28 days, although the exact terms can vary between auction companies, so it’s important to check the agreement in place.

Not all types of extended auction are the same

If your estate agent recommends selling by auction, there’s a good chance they’re referring to a “modern method of auction” – which is a conditional form of extended auction.

In this method, the buyer pays a reservation fee but does not exchange contracts immediately. This means the buyer can still pull out of the purchase, despite having paid a fee. Estate agents often favour this approach because they receive their commission from the buyer – even if the sale doesn’t exchange or complete.

The type of extended auction referred to in this article is unconditional, meaning contracts are exchanged at the end of the auction – just like in a traditional on-the-day auction.

Can a buyer withdraw their bid before the hammer falls?

With both traditional on-the-day auctions and unconditional extended auctions, a bid remains valid and binding as long as it hasn’t been withdrawn. A legally binding contract is created at the moment the auctioneer’s hammer falls, signifying acceptance of the highest bid.

In certain situations, a buyer may attempt to withdraw their bid before this point. However, they must be able to prove that the withdrawal was clearly communicated to the auctioneer before the bid was accepted.

That said, bidders should be aware that by agreeing to the auction’s terms and conditions, they may have already committed contractually not to withdraw a bid once placed. It’s important to note that auctioneers can have different terms for both buyers and sellers, so reviewing these carefully is essential before taking part.

TIP Be cautious in the lead-up to auction day – you may be approached by prospective buyers making direct offers for your property, or receive letters from estate agents claiming they have an interested buyer and encouraging you to withdraw from the auction.

This kind of approach is often intended to disrupt the auction process, with the aim of securing the property at a lower price outside of open competition.

Our advice: pass any such correspondence to your auctioneer, who can assess the legitimacy of the enquiry and, if appropriate, invite the interested party to register and bid alongside other prospective buyers in a fair and transparent process.

On-the-day auction

It’s worth taking a closer look at the format of on-the-day auctions and how they have evolved – particularly since 2020, when the COVID-19 pandemic accelerated the transition from in-person events to online formats, due to restrictions on gatherings and social distancing requirements.

While some auctioneers still run “in-the-room” auctions – where bidders attend a live event at a physical venue such as a hotel ballroom or conference centre – the majority of on-the-day auctions are now conducted online. This shift has been driven by convenience, improved accessibility, and advances in auction technology.

Despite the change in setting, the core structure remains the same: the auctioneer stands at a rostrum, announces each lot, and facilitates competitive bidding in real time. In an online format, this is supported by live video streaming and digital bidding platforms, allowing participants to bid from anywhere in the world. This evolution has made auctions more accessible and cost-effective for both buyers and organisers, removing the need for travel and enabling a broader, more inclusive pool of participants.

Buyers can now place bids online or by phone, depending on their preference. Auctioneers may use their own proprietary platforms or outsource to established providers like EIG (Essential Information Group), known for their reliable, user-friendly systems designed specifically for live bidding.

Even for in-the-room auctions, online and phone bidding options are commonly offered, ensuring maximum participation.

How on-the-day auctions are scheduled – Traditional on-the-day auctions follow a timed format. For example, Lot 1 may be offered at 10:00 a.m., and some auctions may run through hundreds of lots in a single day – sometimes as many as 300. Each lot typically takes 3 to 4 minutes to go under the hammer. While buyers won’t always know the exact time their lot will be presented, auctioneers usually provide an estimated schedule. Many buyers choose to log in early and follow the auction live until their desired lot comes up.

For telephone bidders, the auction company typically calls a few minutes before the lot is offered. Some auctioneers also send text or email alerts around 10 minutes beforehand, reminding bidders to log in and get ready to place their bids.

The bidding experience – Bidding at an on-the-day online auction mirrors the experience of an in-room sale. The auctioneer will conduct the bidding in real time, with live updates visible on the platform, creating a fast-paced and transparent process.

This hybrid model – combining the structure of traditional auctions with the accessibility of modern technology – has made on-the-day auctions more efficient and inclusive than ever before.

When the lot is introduced at an on-the-day auction, the bidding process in an online setting closely mirrors that of an in-the-room auction:

How bidding works at an on-the-day auction (online or in-the-room)

When a lot comes up at an on-the-day auction, whether held online or in a physical room, the process follows a well-established format designed to create momentum and excitement.

The auctioneer begins by introducing the lot – announcing the lot number, property address, and a brief description, such as: “A three-bedroom semi-detached house in good condition.” To build anticipation, the auctioneer may also highlight early interest or the number of legal pack downloads, setting the tone for a competitive atmosphere.

This introduction is the auctioneer’s moment to engage the audience, generate energy, and set the stage for dynamic bidding – a hallmark of traditional on-the-day property auctions.

Opening the bidding – Bidding usually starts at the guide price, with the auctioneer clearly stating the initial bid and explaining the bidding increments – commonly £10,000 at the outset. These set increments help keep the auction structured and fast-paced.

As buyers compete, the bids rise steadily, creating an electric atmosphere – especially rewarding for the seller watching their property’s value climb in real time.

Adapting to the pace of bidding – If bidding begins to slow, the auctioneer may lower the bid increments to reignite momentum. For example, in a recent auction for a high-value property, reducing the increment from £10,000 to £2,000 brought hesitant bidders back into the action, ultimately pushing the sale price well above the reserve.

Should bidding stall, the auctioneer will often step in to re-engage interest, highlighting key features such as location, investment potential, or proximity to amenities. For instance, they may mention a property’s proximity to sought-after schools or its strong rental yield – reminding bidders of its long-term value.

This is where an experienced auctioneer shines. Through storytelling, highlighting unique selling points, and using humour or personal anecdotes, skilled auctioneers can build rapport and reignite the room – or online audience. Their ability to read the mood and adapt their tone can have a real impact on the outcome.

Final countdown and sale – Once bidding reaches its natural conclusion, the auctioneer signals that the lot is about to close. They typically announce: “Going once, going twice, going for the third and final time,” pausing to allow any final bids. The length and tone of this pause are often used strategically – an extended or dramatic pause can give hesitant bidders that last nudge to act.

This process may be repeated a few times to ensure every opportunity to bid has been given. When no further bids are received, the auctioneer brings down the gavel and confirms the sale with a final announcement:

“Sold for £[amount] – congratulations to the buyer, and thank you to everyone who took part.”

Single bidders and “off-the-wall” bidding – In cases where there is only one genuine bidder, the auctioneer may use a tactic known as “off-the-wall” bidding – placing fictitious bids to simulate competition. This is a legitimate and commonly accepted practice, used to help reach the reserve price, which is the minimum the seller has agreed to accept.

What happens if the property doesn’t sell on auction day?

If bidding doesn’t reach the reserve price, the auctioneer will declare the lot “unsold” or “available”. However, this doesn’t mean the opportunity to sell is lost – there’s still a strong chance of securing a post-auction deal.

After the auction, the auctioneer will often follow up with interested parties, contacting prospective buyers via phone calls, emails, or by facilitating private negotiations. The auctioneer might say something like, “We’re not going to let it go at that price,” or express surprise at the result, reinforcing that the property offers excellent value. The language and tone used at this stage are crucial – they can influence buyer perception, create a sense of urgency, or prompt renewed interest.

A confident, reassuring approach may help buyers see the property’s value, while a more direct tone can open the door to swift negotiation. For example: “I’m sure a deal can still be done. If you’re interested, speak to one of my colleagues after the auction.”

In some cases, the auctioneer may recommend re-listing the property in a future auction. While this can provide a fresh opportunity, it may also require a revised marketing strategy or a more competitive guide price to attract stronger interest the second time around.

Most traditional on-the-day auction houses run events every 4 to 6 weeks, giving sellers a practical window to regroup, remarket, and relaunch the property with improved positioning.

Extended auction

Auction day functions quite differently in extended auctions compared to traditional on-the-day auctions. For starters, properties sold via extended auction are not assigned a lot number, as each listing runs independently rather than as part of a grouped catalogue. This format allows both auctioneers and buyers to focus fully on each individual property without the distractions of multiple simultaneous lots.

For buyers, this structure offers greater flexibility and time to evaluate a property thoroughly. For sellers, it ensures their property receives undivided attention throughout the auction period, which can lead to stronger interest and more competitive bidding.

Each property essentially runs in its own dedicated auction, with a unique end time – for example, Thursday at 2 p.m. Prospective buyers are clearly informed of this deadline and know exactly when they must place their final bid.

A longer bidding window with strategic advantages – Extended auctions typically run for around one month, giving buyers ample time to conduct due diligence, arrange financing, and make informed decisions. This longer window allows buyer interest to build gradually, which can lead to a cumulative momentum effect – early bids often attract further attention and create a competitive atmosphere.

For sellers, the extended timeframe increases visibility and engagement, attracting a wider pool of bidders, including those who may need more time to consider their options. This dynamic can often result in higher final bids compared to the shorter, more intense format of traditional auctions.

While buyers are encouraged to place early bids, it’s common for many to wait until the final hours – or even minutes – of the auction, heightening the competitive tension as the deadline approaches.

Flexible end dates – One of the key features of extended auctions is the ability to adjust the end date based on interest levels and seller requirements. Auctioneers monitor enquiry volume, bidder activity, and buyer feedback to determine whether to shorten or extend the auction period.

- If a property receives strong early interest, the auctioneer may recommend bringing the end date forward to capitalise on momentum. This can create a sense of urgency among buyers, encouraging faster and more competitive bidding. For instance, in a recent case, the auction end date for a popular commercial property was moved up by three days due to a surge in early bidding – ultimately resulting in a final sale price 15% above the reserve.

- If interest is slower than expected, the auction may be extended to allow more time for marketing and outreach. Auctioneers may ramp up promotional efforts, such as targeted social media campaigns, personalised emails to potential buyers, or virtual property tours. These strategies are effective in reigniting interest and drawing in new bidders.

“Auction Day” in the context of extended auctions

While extended auctions span several weeks, the final day of bidding – the property’s closing deadline – is still often referred to as auction day. This is when competitive bidding tends to peak, and key decisions are made.

To make the comparison between extended and on-the-day auctions clearer, the next section focuses specifically on this closing stage. Although extended auctions take place over a longer period, it’s the final moments – when the clock counts down and bids come in – that most closely mirror the high-energy, fast-paced environment of a traditional on-the-day auction.

- Each auction has a fixed closing time (e.g. Tuesday at 2:00 p.m.), and all prospective buyers are notified of this in advance.

- If a bid is placed shortly before the deadline (e.g. at 1:55 p.m.), the auction is automatically extended by 15 minutes.

- Should another bid come in during this extension period (e.g. at 2:05 p.m.), the clock resets again for an additional 15 minutes. This process can continue, resulting in competitive bidding that stretches well beyond the original end time – meaning an auction scheduled to close at 2:00 p.m. might run until 5:00 p.m.

- This flexible closing system allows each property to reach its full market potential, free from the time constraints of traditional on-the-day auctions, where auctioneers must quickly move through a packed schedule of lots.

- Once bidding has stopped and no new bids are received within the final 15-minute window, the property is marked as sold, and the auctioneer proceeds to exchange contracts, making the sale legally binding.

What happens if bidding doesn’t meet the reserve price in an extended auction?

If bidding ends without reaching the reserve price, an extended auctioneer has several flexible options. They can either seek the seller’s permission to reduce the reserve and accept the highest bid, or they may recommend extending the auction – by a day, a week, or even longer – to allow more time for further interest to develop.

For example, imagine the reserve is set at £400,000, but bidding has only reached £390,000 when the auction is due to close. In this scenario, the auctioneer will consult with the seller to review their options. If there are late-stage buyers still showing interest, the auctioneer might propose a short extension to give those parties time to act – perhaps they just need a few more days to arrange finances or complete due diligence. With this additional time, bidding may well reach or even surpass the reserve.

Alternatively, if it’s clear that all serious interest has already played out and no new bidders are likely to emerge, the auctioneer may advise that extending the auction further is unlikely to change the outcome. At that point, the seller must decide whether to accept the highest bid by lowering the reserve.

Why this flexibility matters – This level of control and transparency is one of the key advantages of selling via extended auction. It gives sellers the opportunity to “test the market” – something that’s often much harder to achieve through a traditional estate agency sale.

Consider a typical estate agency scenario:

A property is listed for £400,000, and the seller receives an offer at that price. The agent checks the buyer’s financial position, puts up a “Sold” sign, and takes the property off the market. If another, potentially stronger buyer appears days later, they’re unlikely to make an offer on a property that’s already marked as sold. Even if they do, the agent is unlikely to encourage switching buyers or initiating a contract race.

That second buyer might have a higher offer and better funding in place – but the “Sold Subject to Contract” label (on portals like Rightmove or the sale board outside) acts as a deterrent. Even if the estate agent hints at other interest to spark a higher offer, the process is far from transparent or truly competitive.

How auctions are different – With auctions, these barriers don’t exist. The property remains available until the auction officially closes, and bidding continues even after the reserve is met. There’s no “sold” sign the moment a satisfactory bid is placed; instead, the process stays open – allowing buyers to outbid each other freely and fairly.

This is what auctioneers mean when they talk about “testing the market” – not relying on a fixed asking price, but letting competition reveal what buyers are genuinely willing to pay. It creates a more dynamic, open, and competitive environment – ultimately increasing the chance of achieving the best possible price.

Even if bidding falls short of the reserve, extended auctions give sellers valuable insight. They’ve effectively tested the market, and the highest bid received reflects what the open market is currently willing to offer. From there, the seller can make an informed decision – either to accept that offer (and exchange contracts) or to relist, adjust strategy, and try again.

What happens if the winning bidder fails to pay the exchange deposit?

In both on-the-day and extended auctions, it’s rare for a winning registered bidder to fail to pay the required deposit after the auction concludes. By winning the auction, the bidder enters into a legally binding contract to purchase the property.

If the deposit isn’t paid within the agreed timeframe, it is considered a breach of contract. This can lead to serious consequences, including the potential for legal action against the buyer to recover losses or enforce the terms of the sale.

The final stage in the process of selling your property at auction is completion day – the point at which full legal ownership of the property transfers from you, the seller, to the buyer. This marks the official conclusion of the transaction.

In most auction sales, completion occurs 28 days after the exchange of contracts, which typically takes place on the day of the auction. However, this timescale can vary if a different period has been agreed in advance and is clearly set out in the auction legal pack. For example, some sales allow for 14 days or up to 56 days depending on the property type, the seller’s needs, or buyer preferences.

On completion day, your solicitor will confirm that all remaining funds have been received from the buyer’s solicitor, and only then is the transaction deemed legally complete. You will usually receive a confirmation phone call or email from your solicitor and/or the auctioneer once this has happened. From this point forward, the buyer assumes full legal responsibility for the property, including any risk or liability.

For sellers, completion day also triggers the release of sale proceeds. After settling any outstanding amounts – such as mortgage balances, secured debts, legal fees, and auctioneer’s commission – your solicitor will transfer the net funds directly to your nominated bank account. It is also the moment you must ensure you’ve vacated the property (if selling with vacant possession), handed over all keys, and completed any final admin such as utility notifications or mail redirection.

Because completion is a legally binding event, it’s important that everything is prepared well in advance – keys transferred, belongings cleared, and all paperwork finalised – to avoid delays and potential breach of contract. Planning ahead helps ensure a smooth and stress-free conclusion to your property sale.

Completion Date Is Pre-Set