Costs for Selling a House at Auction in the UK

Request a free & no-obligation auction sale price estimate

- Cost effective

No upfront fee & sell for free options - Quick

Sell your property in as little as 28 days - Secure & reliable

Legally binding sale on auction day - Fair & transparent

Sold to the highest bidder

For your peace of mind we are a member of The Property Ombudsman

Selling by auction is quick and easy. Request a no-obligation auction sale estimate for your house or flat.

- Reliable

- Fast

- Secure

Interested to learn more about the easy and efficient process of selling your property by auction?

Talk to our team on 0800 862 0206

Home: Auction Link » Cost of Selling Property at Auction (July 2025)

How much does it cost to sell a property at auction? A guide for UK property owners. How much does it cost to sell a property at auction and how do the sale costs compare to an estate agency sale? Find out about the costs for selling your house or flat at auction and how to save money by passing some of your costs to the buyer.

Last updated by Mark Grantham on 2 July 2025

Video Guide: Costs for Selling at Auction

In this guide:

Costs for selling a house by auction

Passing costs to the buyer

Negotiating commission

Auction legal pack

Survey

Cancellation or withdrawal

Other sale costs

Cost of not selling

Cost benefit analysis

More auction help

Questions

Next steps

Property auctions update

Costs for selling a house by auction?

Request a free valuation and auction sale cost estimate for your property today. In some cases we may need a few more details about your property before providing a free and no-obligation auction sale estimate.

Selling a property at auction costs less than most people think. The total cost is about the same you would expect to pay a traditional high street estate agent. There are 3 costs to consider when selling a property at auction:

(1) COMMISSION – The auctioneers commission is around 2% + VAT of the final sale price and that’s only paid when the property successfully sells.

(2) ENTRY FEE – Most auctioneers request an upfront catalogue/entry fee of around £300 + VAT or more, but it may be possible to postpone payment until after the property has successfully sold.

(3) AUCTION LEGAL PACK – The seller’s solicitor is responsible for preparing the auction legal pack at the cost of £200 or more, which is payable before the auction.

By adding a simple clause to the contract of sale it’s possible to pass all (or part) of your auction costs and legal fees to the buyer, in fact it’s standard practice for regular auction sellers (e.g. property traders, banks and local authorities). Some buyers will not bid as high for the property if they spot the clause in the legal pack, but others will not worry.

The starting rate for an auctioneer’s commission will usually be around 2% + VAT or more and that’s only paid when the property successfully sells. So if a property sells for £200,000 the commission payable to the auctioneer would be £4,000 + VAT.

The costs for selling a house at auction include a commission of 2%+VAT of the final sale price, only paid upon successful sale. Plus an entry fee, although some auctioneers don’t charge for this. Your solicitor will need to prepare an auction legal pack costing upwards of £200.

You can save money by passing some costs to the buyer.

For higher value or particularly saleable properties the auctioneer might be prepared to reduce their commission, but there is a lot of organising and marketing that takes place for the auctioneer to be able to justify their fee.

Auctioneers usually charge a minimum selling fee of anything from £1,500 upwards – so if a low value property (such as a garage) sells for £10,000 the 2% commission rate will not apply, otherwise the fee would only be £200. Instead the auctioneer will charge the minimum selling fee.

TIP: Compared to some of the newer methods of selling, such as paying an online estate agent a fixed fee, selling a property at auction may seem relatively expensive. So it’s worth a quick cost benefit analysis to see if auction will pay off for you.

The auction legal pack is crucial for the successful sale of a property at auction, it contains all the legal information (e.g. land registry documents, deeds, searches, property information questionnaires, lease documents, tenancy agreements etc) relating to the property. So the more information there is in the legal pack the more confident prospective buyers will be when bidding on auction day. It’s therefore important not to cut costs when preparing the legal pack as it may adversely affect the final sale price. Costs for preparing an auction legal pack for a freehold property can be anything from £200 upwards. For a leasehold property the cost of obtaining the management information pack from the freeholder/landlord will add another £200 or more.

Most of these legal costs are not unique to selling at auction. When selling through an estate agent or privately the seller will also need to prepare legal documents for the prospective buyer. It’s only the searches (local authority search, water search etc) that are obtained by the buyer in the case of an estate agency sale, but by the seller in the case of an auciton sale.

We’re occasionally asked whether the seller needs to include a survey report for their property in the auction legal pack. The survey report is NOT the responsibility of seller. There is no expectation for a survey report to be included in the auction legal pack.

Many of the buyers at auction are cash buyers, so will not require a survey. However, if the buyer does require a survey, they will need to have sorted that out (and seen the report) before bid on auction day. With an unconditional auction sale, the buyer is bidding to buy – full stop! They’re not bidding to buy subject to contract or survey.

It’s worth noting that if you signed the auctioneers’ terms remotely (i.e. not in the auctioneers office) there will usually be a 14 day cooling off period. However, since the timescales for selling at auction are very quick, the auctioneer might ask you to tick a box on the auction contract that waives your right to cancel, in order for them to commence their service immediately, and begin marketing your property as soon as possible.

As with selling a property through an estate agent or privately, there are other costs to be considered when selling a property, they include; legal fees, moving costs and taxes that might be due. For example capital gains tax on buy-to-let properties and inheritance taxes for probate sale. Also consider whether any early redemption penalties might be due on your mortgage or secured loans. These are all payments your solicitor will be able to help you calculate when determining your bottom line sale price i.e. your reserve price.

If the property doesn’t sell at auction there will usually not be any costs or obligations to the seller, unless stated in the auctioneers terms.

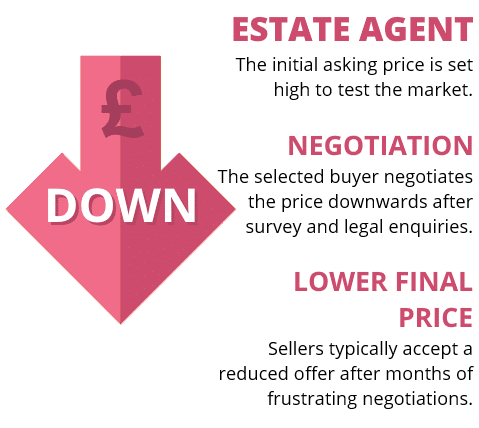

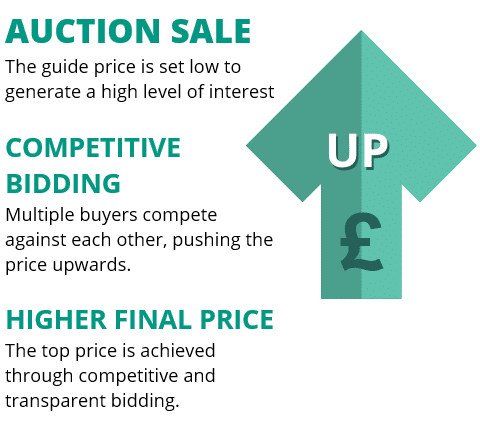

With so many low-cost online estate agents to choose from, does an auction sale provide value for money? Apart from the speed and reliability an auction sale offers, from a purely financial perspective, is it worth it? Can you achieve a higher sale price at auction compared to any other method of sale? The answer depends on the type of property being sold – some properties sell for considerably more at auction compared to estate agency sales due to two key features of auction; competition and transparency.

Competition – Property developers, amateur DIYer’s and ambitious owner occupiers will compete to buy a property at auction in the knowledge they’ll be able to refurbish it cost-effectively and either sell on for a profit or live there themselves. The key word being compete. In an auction environment, where the price can only go one way (up) it’s the competitive bidding environment that drives the price up.

Transparency – In a closed/private sale environment, such as an estate agent sale (also known as a “private treaty” sale) the estate agent has a high level of influence over negotiations. If after a few months of marketing a property the estate agent tells the seller that £100,000 is a fair price, the seller will probably be inclined to accept an offer around that level. By keeping the property in the hands of one or two estate agents the the sale lacks transparency.

In fact, a highly lucrative market exists for property traders who purchase problem properties through estate agents one week and flip them at auction the next week – the properties are sold for considerably higher prices as “properties with potential” in the the transparent and competitive bidding environment that’s found at public auction!

Ready for auction?

Request a free valuation and reserve price estimate for your property today. In some cases we may need a few more details about your property before providing a free and no-obligation auction sale estimate.

Questions and Answers

✅ Do properties sell for lower prices at auction?

Some types of property are particularly well suited to sale by auction; properties in need of modernisation or with potential are ideal for auction and will achieve a higher sale price at auction compared to an estate agency sale. But properties with their potential exhausted will usually sell for more by private treaty (estate agency) sale, unless the property is unique or in a very good location, in which case the top price may be found through competitive bidding at auction.

✅ What happens if an auction property doesn’t sell?

Most properties do successfully sell at auction, it’s considered the most reliable method of sale. If bidding doesn’t reach the reserve price on auction day your property will be made available as an unsold lot. The auction company will contact all interested buyers and ask for their best and final offers. If a property doesn’t sell first time around it can be entered into a subsequent auction, that might be 4 or 6 weeks later.

✅ What costs are paid upfront and after an auction sale?

The costs for selling at auction works out to be about the same as using a good high street estate agent. Commission at around 2% + VAT if the final sale price is only payable on successful sale. Some auctioneers charge an upfront entry fee of £200 to £500, but this can be negotiable and only payable after sale.

✅ How quickly can a property be sold at auction?

Legal exchange of contracts can take place within 3 to 4 weeks, with completion of sale a further 4 weeks later. Timings are flexible; if a seller needs to complete sooner or later, they can ask their solicitor to shorten or extend the completion date.

✅ How do you find a good local property auctioneer?

There are hundreds of property auctioneers in the UK. The best suited auctioneer for your property will depend on the property type and location. Looking at the past auction results (usually available on the auctioneer’s website) can be a good starting point to short list a suitable auctioneer.

Summer 2025 Property Auctions Update

What can we expect from the property market for the remainder of 2025?

Over the past year, two principal factors have continued to dominate the housing market: rising interest rates and the soaring cost of living. Although the Bank of England eased rates from 5.25% in July 2024 to 4.25% in May 2025 – further reductions are anticipated this year – a development that could help stabilise buyer sentiment.

Another significant influence on the market has been the government’s autumn Budget (30 October 2024), particularly the introduction of a 5% stamp duty surcharge on additional properties (second homes and buy‑to‑let). While the certainty provided by clear fiscal policy has supported consumer confidence, the surcharge has understandably weighed on appetite for investment homes.

Recent developments

Rising costs, driven by global supply chain disruptions and international trade tensions, have added to broader economic uncertainty. These pressures are filtering through to various sectors, including housing, leading many prospective buyers to adopt a more cautious approach. As a result, some are delaying property purchases, which has contributed to a slight slowdown in market activity.

Meanwhile, sentiment among both buyers and sellers remains fragile. Although the availability of mortgage finance has steadied, many remain concerned that upcoming interest rate cuts may not materialise as quickly or as significantly as hoped.

Is it sensible to sell a property by auction in a cooling market?

1. Reserve pricing

When selling your house by auction, you must agree a reserve price – typically set below the market value to encourage bidding and ensure a sale within one to two months.

2. Why below market value?

- Bidding potential: Auction day may spur multiple bids, pushing the final price well above the reserve. However, in a cooling market, competitive bidding cannot be guaranteed. You must be comfortable accepting the reserve as the minimum sale price.

- Binding commitment: A key advantage of auction is the legal certainty it provides. Once the hammer falls, the sale becomes binding at the current price – shielding you from any further decline in market values.

Summary: auction in today’s market

Selling by auction in a softer market remains a strong option if:

- You agree to a realistic reserve price.

- You prioritise a quick, legally binding sale.

- You understand bidding may be limited during periods of economic uncertainty.

On the other hand, if your property is high‑value or uniquely appealing, or if you can afford to wait for a more favourable climate, a private sale might yield better returns – albeit with a longer timeframe and no guarantees.

Securing a legally binding sale with the prospective of competitive bidding certainly sounds compelling, but an auction sale doesn’t suit everyone’s circumstances. Please explore our guides to selling by auction or contact us to find out if auction is a suitable option for you.

If a property sells at auction for £200,000 the commission due to the auctioneer would typically be 2% + VAT which would be £4,000 + VAT only payable after the sale.

Prefer to talk?

Need help deciding if auction is right for you? Call 0800 862 0206 or request a call back for later.