Selling a Tenanted Property?

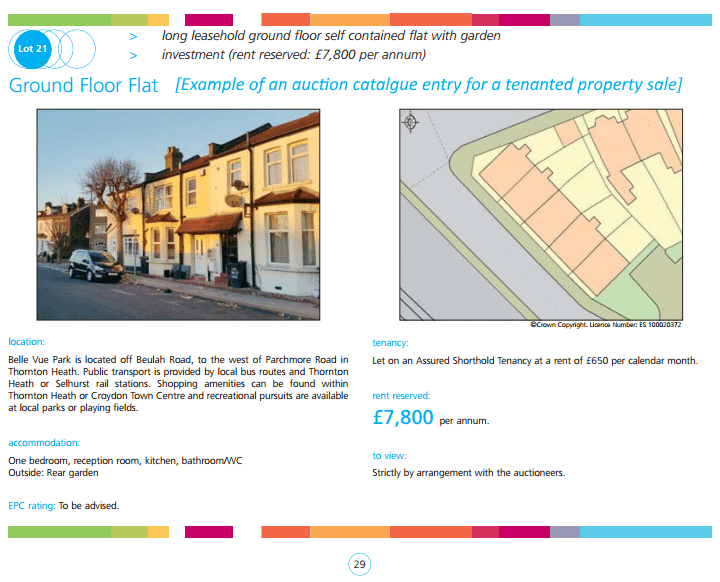

Sometimes it can be easier to sell a tenanted property as is, without serving notice on the tenant to vacate. And there are plenty of property investors looking for “already tenanted” properties at auctions throughout the UK.

For your peace of mind we are a member of The Property Ombudsman.

Call 0800 862 0206 for your FREE sale price estimate

Home: Auction Link » Property Types » Selling a Tenanted Property

Last updated by Mark Grantham on 13th January 2025

Why sell a tenanted property at auction?

Most people are familiar with the traditional route of selling a vacant property through an estate agent as it’s the method of sale most people choose when they move house. There is no reason why a tenanted property cannot be sold through an estate agent, it just requires the estate agent to find a property investor who’s prepared to pay a fair price.

However, the issue some sellers encounter when they sell a tenanted property though an estate agent (or direct) is that the sale is at risk of falling through (or the price being reduced) because the contract of sale has only been sent to one buyer. A sale fall through or price reduction could be for any reason, including the possibility of the investor having found a better purchase elsewhere!

Selling a Tenanted Property?

How much will your tenanted property sell for by auction? Request a free valuation and reserve price estimate for your tenanted property. In some cases we may need a few more details about your property before providing a free and no-obligation estimate.

When selling a tenanted property, public auction offers a very good alternative to a (private treaty) sale through an estate agent, not least because the fate of the sale is not at the mercy of the one, individual buyer. Auction offers the ideal way for property owners to sell at a fair price, in the quickest possible time.

Need some help? Call us on 0800 862 0206 or send us an enquiry online.

Will your tenanted property sell at auction?

– Rental income is obviously very important to an investor. The investor will take into account the cost of finance (buy-to-let mortgage) and other outgoings when calculating their return on investment. If you’re selling a property with a yield in excess of 5% in London or in excess of 9% anywhere else in the UK then that will be considered a good return.

– Covenant strength of tenant – if you’re selling a property where the tenant has always paid their rent on time and there has been no history of problems, then that will look good to any prospective investor buyers.

– Property type – some investors stay clear of certain types property, regardless of the rental yield. For example, some high-rise ex-local authority properties can be difficult to re-finance so won’t be as attractive from an investment standpoint.

– Capital appreciation – for some investors this is the most important factor. Many overseas buyers invest in vacant London property (without any rental income) because they know it represents a secure investment.

Selling a (problem) tenanted property at auction

We’re often approached by property landlords who have run into problems with their tenants and have the option of taking legal action against the tenant, or selling the property at auction with the problem tenant still in place. Typical tenant issues include rent arrears, anti-social behaviour, damage to property or subletting the property without permission.

Although there are property investors that specialise in dealing with problem tenants, the price they offer will be below market value. Selling a tenanted property at auction can be a quick and straightforward way to off-load a problem, but it’s always worth looking at your options before selling at a discount; negotiating with the tenant or threatening/taking legal action against the tenant are always worth exploring first.

It’s worth noting that selling by auction is by no means restricted to problem situations. There are many perfectly good tenanted properties sold at auction, for the reasons stated in the first paragraph.

Find out more about auction reserve prices and why they’re so important!

How much notice do I need to give my tenant?

Whilst it is possible to sell a tenanted property at auction, the sale price will typically be higher if you are able to sell a property with vacant possession. The audience of buyers for a vacant property will include owner-occupier buyers, who will usually pay more for a property, compared to a buy-to let investor.

Eviction Notice Periods in England and Wales

England

Section 21 Notice (No-Fault Eviction)

- At least two months’ notice is required.

- Notice cannot be served within the first four months of the tenancy.

- Landlords must provide essential documentation, such as:

- Gas Safety Certificate

- Energy Performance Certificate (EPC)

- Prescribed information for tenancy deposits

- Copy of the government’s “How to Rent” guide

Section 8 Notice (Fault-Based Eviction)

- Notice period depends on the grounds for eviction.

- For serious rent arrears, at least two weeks’ notice is required.

Wales

Standard Occupation Contracts

- Six months’ notice is required for no-fault evictions.

- Notice cannot be given until six months after the start of the contract.

Breach of Contract

- Shorter notice periods may apply for breaches such as rent arrears or antisocial behavior.

Visit the UK Government website for up-to-date information about serving notice to your tenant.

If you have been using a letting agent to manage the rental of your property, the obvious choice might be to appoint the same agent (assuming they deal with sales) to help sell your property. It would make sense to keep the letting agent onboard as they can liaise with the tenant regarding viewings, and they will probably know the property better than a newly appointed agent might.

However, it’s worth considering there may be a conflict of interest in appointing your letting agent to help sell your property. After all, once your property is sold, the letting agent will no longer receive their letting management fee. In the longer term, a letting agent will make a greater profit by continuing to rent your property, than they would from a one-off commission payment for the sale.

And on that note, if the property your looking to sell is currently vacant, but an estate agent has suggested they find you a tenant, instead of selling the property, we suggest taking moment to consider if the estate/letting agent is acting in your best interests. As described above, the income an agent will receive from managing a rental property will be far greater in the longer term, compared to a one-off commission payment from a sale. And once your property is tenanted, it might be some time again before you get the opportunity to sell.

When selling a property that is not your own home, you may be liable to payment of Capital Gains Tax, regardless of whether the property is sold tenanted or vacant.

Capital Gains Tax (CGT) is based on the difference between the amount you paid for your property and the amount you got when you sold it. Certain expenses, such as costs related to improvements or the sale process, may be deductible, potentially reducing your CGT liability.

And there may be an exemption, or partial exemption under the Principal Private Residence (PPR) relief. This can significantly reduce or eliminate your CGT liability. Seeking professional tax advice is recommended to fully understand your eligibility for such exemptions.

It’s advisable to take specialist tax advice, but to get an initial idea of whether you will be liable to paying Capital Gains Tax on the sale of a residential property, you might find it useful to try an online Capital Gains Tax calculator.

If you’re selling a property in the UK while living abroad, there are special rules for calculating Capital Gains Tax. Non-residents are required to report and pay CGT on UK property sales within a specific time frame, often within 60 days of the transaction. Ensure you comply with these regulations to avoid penalties.

- Renters’ Rights Bill 2024: Introduced by the Labour government on 11 September 2024, this bill aims to enhance tenant protections and reform the private rented sector. Key provisions include:

- Abolition of ‘No-Fault’ Evictions: The bill proposes ending Section 21 ‘no-fault’ evictions, requiring landlords to provide valid reasons for terminating a tenancy. (Source)

- New Grounds for Possession: Landlords intending to sell their property can seek possession under a new mandatory ground (Ground 1A) but only after the tenant has resided in the property for at least one year. Tenants will benefit from a 12-month protected period at the beginning of a tenancy, during which landlords cannot evict them to move in or sell the property. (Source)

- Notice Periods: The bill requires landlords to provide a four-month notice period when seeking possession to sell the property, giving tenants more time to find alternative accommodation. (Source)

- Stamp Duty Changes: In October 2024, the UK government increased the surcharge on stamp duty for second homes, including buy-to-let properties, from 3% to 5%. This change aims to favor first-time buyers but may impact the attractiveness of investment properties. (Source)

Selling a tenanted UK property from overseas?

Read our guide to selling a tenanted UK property when you’re living overseas and why auction is a convenient and transparent method of sale.

Next steps…

Selling tenanted?