Selling a Leasehold Flat

Selling a leasehold flat in England & Wales? The process for selling a leasehold property is more complex than selling a freehold property. This article provides sellers of leasehold flats with some useful tips towards ensuring a successful sale, either through an estate agent or by auction.

Call 0800 862 0206 for your FREE sale price estimate

If you’re selling a leasehold flat in England and Wales, we suggest that preparation is key to ensuring a successful sale and avoiding unnecessary delays. This article provides guidance to help leaseholders navigate the process with some simple and practical steps.

Updated by: Mark Grantham on 25th June 2023

The information provided in this article is for guidance purposes only. The Law Society website provides a directory of conveyancing solicitors to help with the sale of your leasehold flat.

Please feel free to contact us if you’re looking to sell your leasehold flat. We’ll be happy to talk you through the pros and cons of selling a leasehold flat by auction. And help you decide whether or not an auction sale is suitable for you.

What’s the difference between leasehold and freehold? In practical terms, if you own a freehold house it means you own the house and the land it’s built on. But for leasehold, you only own the building (or part of the building) – and only for a set period of time. Leaseholders do not own the land their property is built on.

Although there are some leasehold houses in the UK, most houses are freehold and most flats are leasehold. In 2019 the UK government banned all new-build houses from being leasehold, so all new-build houses are now sold as freehold. And legislation passed by the Scottish parliament in 2004 effectively brought leasehold to an end in Scotland.

Leasehold ownership will usually be a lengthy period; initial lease terms are typically 90 to 120 years, but can sometimes be 999 years – often referred to as virtual freehold. Leases can be extended, and in some cases a leaseholder might own a share of freehold too.

This article focuses on the process of selling a leasehold flat, which can be more complicated than selling a freehold, because leaseholders will have a contract (lease) with the freeholder which sets out responsibilities between the leaseholder and the freeholder. For example, the freeholder might have the responsibility to maintain roof and other parts of the building, but the leaseholder will be required to pay the freeholder an annual service charge for that maintenance work. These responsibilities and obligations mean leaseholders will need to fill in a few more forms and solicitors will need to carry out additional work, compared to selling a freehold property.

There are a few simple and low-cost checks you can carry out when looking to sell your leasehold flat. These checks can be carried out before marketing your property for sale by auction or with an estate agent. In fact, an estate agent or auctioneer might ask you some questions about your flat when they appraise the property for a valuation, so carrying out these checks early will mean you have answers to their questions and you will receive an accurate valuation for your leasehold flat.

Summary of checks before selling a leasehold flat

- Long enough lease length?

- Freeholder / managing agent contactable?

- Reasonable service charge and ground rent?

- EWS1 report (if relevant) or fire risk assessment?

- Suitability for mortgage lending?

Don’t worry if you’re not in a position to carry out these checks yourself, there’s no requirement for you to do so. Your solicitor will eventually carry out these checks anyway.

☑ Check 1: How many years remain on the lease?

It’s worth finding out how many years remain on your lease. If you know an approximate number that’s fine; for example, if you purchased your flat 5 years ago with 110 years remaining on the lease, you know the lease now has 105 years remaining.

🔲 Knowing the lease length – why it’s important?

The value of your leasehold flat reduces as the term (number of years) remaining gets shorter. When the lease length is below 80 years, the cost of a lease extension increases dramatically and might not be suitable for mortgage lending, so a lease with 80 years or less can be harder to sell.

If you’re not sure how many years remain on the lease, you will be able to find out by requesting the “leasehold title document” (also referred to as the title register) from the Land Registry website. There will be a nominal fee for doing this (currently £3.00) and you will need to create an account with Land Registry before you can download the document. This can be done within 5 to 10 minutes and you will be able to download the lease title document as a PDF straight away. If you search the Internet for “lease title document land registry” make sure you click on a “.GOV” website and not a third party website, otherwise you might be charged a higher fee.

Here is a link to the Land Registry website:

https://www.gov.uk/search-property-information-land-registry

Be sure to select the “lease” title and not the freehold title. If you need help, the phone number for Land Registry is 0300 006 0411.

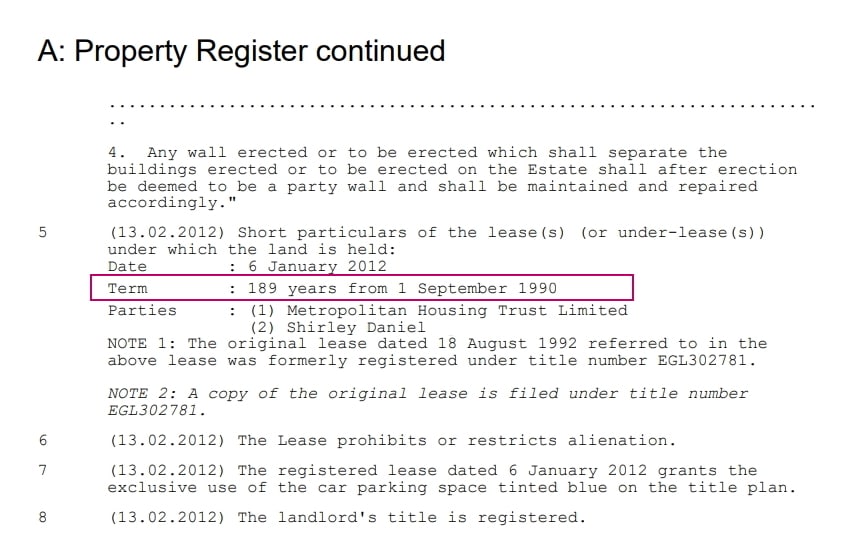

Once you have downloaded the title document, on the second or third page you should see a section similar to the example below.

Extract from a lease title document – the lease term

The above extract of a leasehold title document shows the information you need (for privacy reasons, we have changed the personal details in the title document). We have highlighted the relevant part in pink. In this example, the term of the lease is 189 years commencing from the year 1990. To calculate the current time remaining on the lease: add 189 to 1990 and deduct the year we’re currently in.

Calculating the time remaining on a lease

The original lease term is 189 years, starting in the year 1990.

For example: 189 + 1990 = 2,179

And now deduct the current year from 2,179

For example: 2179 – 2023 = 156 years

In this case, as of the year 2023 there are approximately 156 years remaining on the lease.

A lease with 156 years is plenty! It’s only when the lease is approaching 80 years (and certainly when the lease has 80 years or less) remaining that a sale might be more difficult.

Does your lease have 80 years or less remaing?

A lease with 80 years or less remaining certainly doesn’t mean your flat is unsaleable. But it might mean the audience of buyers is limited to cash buyers only. If you’re selling a flat with a short lease, your options are to (1) sell the flat as is, with the shorter lease, (2) extend the lease yourself, or (3) give the buyer the right to extend the lease. You might find our article about selling a short lease flat to be a useful read.

Why sell by auction?

✔ Sell to the highest bidder

✔ Sales don’t fall through

✔ Sell leasehold flat quickly

☑ Check 2: Is the freeholder contactable?

There can be serious implications when attempting to sell leasehold flat where the freeholder is not contactable. This is known as having an absent freeholder. Mortgage companies will not usually lend on a property where the freeholder is absent, because the freeholder is not fulfilling their responsibilities under the terms of the lease. As such, mortgage companies might view the property as an insecure investment.

In many cases a leaseholder will not be in direct contact with the freeholder. Instead, there will be an intermediary; typically a managing agent. Where this is the case it’s very likely the managing agent will be in contact with the freeholder, so you needn’t worry if you haven’t heard from the freeholder in a while!

Where a reasonable, but unsuccessful attempt has been made to locate the freeholder, a leaseholder has a few options available to them, to help improve the saleability of their flat.

Options for improving the saleability of a flat with an absent freeholder:

Option 1 – Purchase absent freeholder indemnity insurance. This provides the leaseholder with some protection in case the freeholder suddenly appears and enforces the covenants in the lease e.g. backdated ground rent demands. However, some mortgage companies will still not lend as they may consider the property to be an insecure investment. Absent freeholder indemnity insurance typically costs a few hundred pounds.

Option 2 – Apply for a vesting order. Under the Leasehold Reform, Housing and Urban Development Act 1993, leaseholders can apply for a Vesting Order to purchase the freehold (or to obtain a lease extension). The application must be made to the County Court.

Option 3 – Acquire the freehold. Under Section 33 of the Landlord and Tenant Act 1987, leaseholders can acquire the freehold when the freeholder is in breach of his obligations and as the freeholders absence means their obligation is not fulfilled, the freeholder will be in breach.

Option 4 – Apply for the Right to Manage. Under the Commonhold and Leasehold Reform Act 2002 – this process transfers the management of the building from the freeholder to a management company owned by the leaseholders. This is a relatively inexpensive solution, costing not much more than a hundred pounds. It doesn’t require the freeholders consent or a court order.

For leaseholders who are short on time, or don’t want the hassle of perusing any of the above options, the audience of buyers will be reduced to cash buyers only. When selling a flat with an absent freeholder, it’s important that the seller discloses to the buyer the fact that the freeholder is absent, or not contactable.

☑ Check 3: Are the ground rent and service charge reasonable?

If you own a leasehold flat it’s likely that you make regular payments of ground rent and service charge to the freeholder or their manging agent.

Ground rents and service charges are often a contentious issue. The term “fleasehold” or “fleecehold” is used to describe the practice of freeholders unfairly profiting from overcharging leaseholders with excessive service charges or escalating ground rents.

Ground rents:

In fact, in recognition of this the UK Government stated in 2022: “The reputation of the leasehold system has been damaged by unfair practices that have seen some leaseholders contractually obligated to pay onerous and escalating ground rents, with no clear service in return.” And to see an end to ground rents for most new long residential leasehold properties in England and Wales the Leasehold Reform (Ground Rent) Act 2022 was brought into force on 30 June 2022. This means that ground rents are limited to a peppercorn (a very small amount) rent. This only covers ground rent for new leases and does not deal with excessive service charges. But it’s a start!

One of the big issues with ground rents has been when they “escalate” to an unreasonable level. Ordinarily a ground rent might start off at £50 per year and double every 25 years. At the end of a 99 or 125 year lease the ground rent would be £800 or £1,600 per year. This is a big increase, but taking into account inflation it’s not a completely unfair amount to compensate the freeholder for leasing/renting their land. Unfortunately, in recent times some leaseholders have bought newbuild flats with ground rents doubling every 10 years. So at the end of the lease, what started out as a £200 ground rent ends up being hundreds of thousands of pounds every year. Yes, it sounds ridiculous, but it’s true.

Calculating a “doubling every 10 years” ground rent

Start of lease: Ground rent of £200 per year

After 10 years: Ground rent doubles to £400 per year

After 20 years: Ground rent doubles to £800 per year

After 30 years: Ground rent doubles to £1,600 per year

After 40 years: Ground rent doubles to £3,200 per year

After 50 years: Ground rent doubles to £6,400 per year

After 60 years: Ground rent doubles to £12,800 per year

After 70 years: Ground rent doubles to £25,600 per year

After 80 years: Ground rent doubles to £51,200 per year

After 90 years: Ground rent doubles to £102,400 per year

After 100 years: Ground rent doubles to £204,800 per year

More recently, solicitors have become aware of these unfair ground rent clauses and know to look out for them. So now, when the owner of a property with an excessive ground rent clause comes to sell their flat, the buyer’s solicitor firmly warns the buyer not to proceed with their purchase. And so making these flats very difficult to sell.

Fortunately, most housebuilders have been forced to remove these unfair ground rent clauses. But we do still hear from leasehold flat owners who have not resolved the issue.

Service charges:

The service charge paid by owners of leasehold flats covers building maintenance costs and insurance. Communal areas need cleaning and gutters need clearing. And for older buildings that require a higher level of ongoing maintenance, or luxury flats with porters and communal facilities (e.g. swimming pool and gardens) that additional cost needs to met too. Sometimes leaseholders will also pay into a sinking fund (or reserve fund) which covers the cost of major works e.g. roof repairs or upgrading of communal areas.

For the freeholder to meet their responsibilities of maintaining a building, a good freeholder (or their managing agent) will budget for all ongoing maintenance and services, and request payments from leaseholders on an annual, or sometimes quarterly or bi-annual basis.

The problem comes when service charges increase dramatically or when service charges cannot be reasonably justified. Or in fact, if there is no arrangement in place for service charges to be paid at all.

How do service charges affect the saleability of a leasehold flat?

When selling a leasehold property, the seller will need to request a management information pack (also known as a leaseholders pack, sales pack or LPE1) from the freeholder or their managing agent. There’s more information about the management pack in the section below. The pack will include a statement to show if service charges and ground rent have been paid up to date, or whether any arrears need to be paid upon completion. The pack will usually also include a service charge budget for the year ahead.

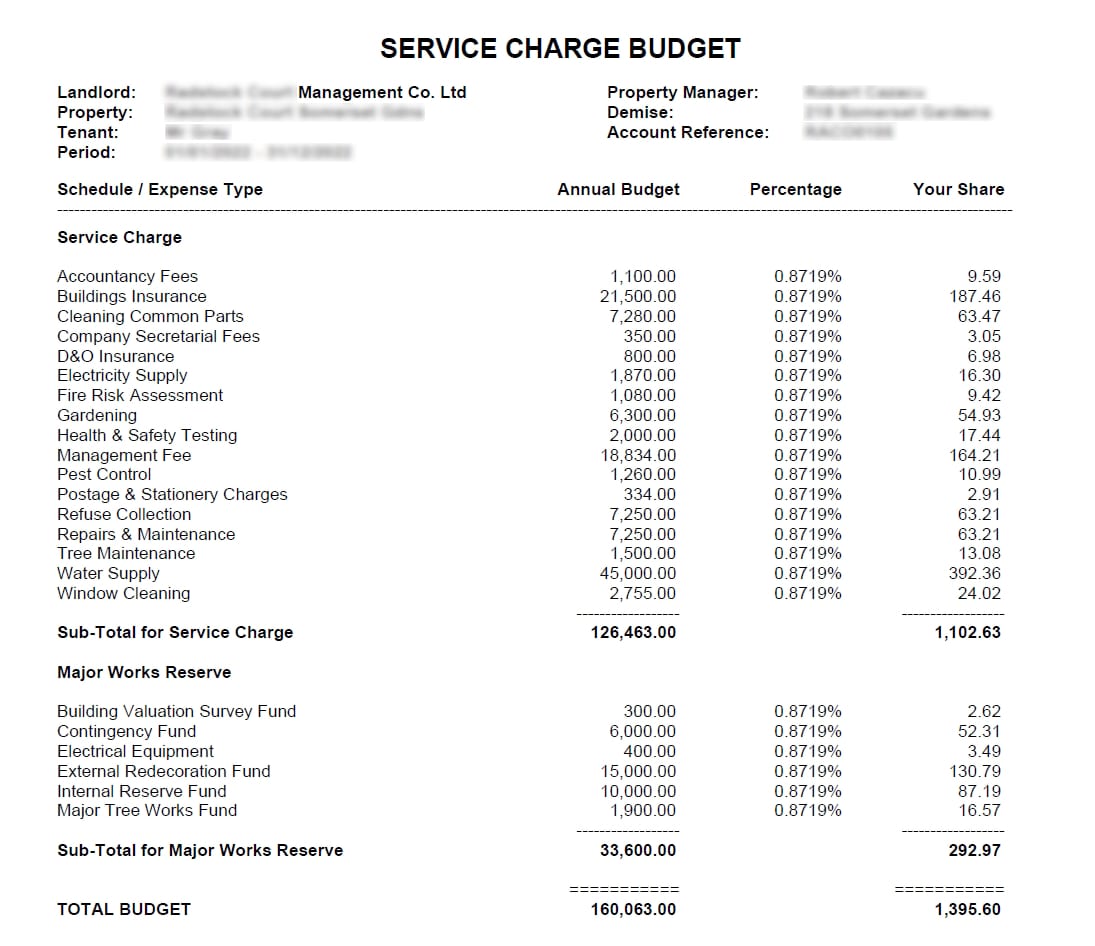

Prospective buyers will expect to see a fair and reasonable service charge budget. The image below shows the expense items that will typically be included in a service charge budget.

Service charge budget for a leasehold flat

If the current or projected service charges are very high, the buyer’s solicitor would usually raise enquiries with the managing agent (via the seller’s solicitors) to determine whether it’s expected they will continue to remain high in the years to come. It’s up to the buyer to decide if they want to proceed with the purchase based on the information they receive. For leasehold flats, this can be one of the key moments when a sale falls through.

Find out why auction sales don’t fall through. Read more…

One of the reasons for higher than usual service charges will be because major works are planned for the building. If there are not already sufficient funds in the sinking/reserve fund to meet the cost of works, additional payment will be requested from the leaseholders. The process involves the freeholder issuing a section 20 notice to the leaseholders within the building.

Receiving a section 20 notice from the freeholder can sometimes be quite a shock. The request for payment might run into thousands, or tens of thousands of pounds. In fact, we often receive enquiries from leaseholders who cannot afford to make payment, so decide to sell their flat instead.

Selling a leasehold flat where a section 20 notice has been issued won’t necessarily put prospective buyers off. The buyer will account for the cost of works when calculating the amount they’re prepared to offer. In simple terms, if a property was valued at £350,000 and the section 20 notice totalled £10,000 the buyer might adjust their offer to £340,000. Apart from the major works potentially causing some disruption for a while, the prospective buyer has the comfort of knowing the building is to benefit from improvement work, and it’s quite unlikely another section 20 notice be issued again too soon.

☑ Check 4: Fire risk assessment – is an EWS1 report required?

Although fire risk assessments for leasehold flats are not a new requirement, the rules have become stricter, particularly for high-rise flats. The external wall system (EWS1) form assesses the materials used in residential developments to check they are safe and do not pose a risk of fire spreading. Where blocks of flats have cladding systems that are unsafe (risk of being combustible) and if a building is over 18 meters high, then remedial work will be needed before an “A rating” EWS1 certificate can be issued to verify the building is safe. Mortgage companies will not lend on high-rise flats without a EWS1 certificate confirming the building is safe.

Even though some developments that are less than 18 meters high supposedly do not require an EWS1 form (because they are considered lower risk in the event of a fire) there has been considerable resistance from mortgage companies to offer lending.

Fire risk assessments consider the material used for external walls, balconies, insulation and firebreaks.

Selling a leasehold flat – fire risk assessment & EWS1

The stricter fire risk assessments have come into force very quickly, since the Grenfell tragedy in June 2017. The shortage of surveyors to carry out fire safety checks on the many affected buildings means there have been delays in assessing buildings.

For the latest updates on this subject, the Royal Institute of Chartered Surveyors (RICS) have a cladding and EWS1 FAQ’s page on thier website.

☑ Check 5: Suitability for mortgage lending?

The lending criteria used by mortgage companies frequently changes. We often hear from leasehold flat owners who purchased their flat more than 5 years ago with mortgage lending, but are now having difficulty selling because prospective buyers are not able to secure a mortgage on their flat. The seller is left wondering why the flat was once suitable for mortgage lending, but a short time later it’s not.

Market conditions can influence whether a mortgage company will lend. Generally speaking, a mortgage company will be more cautious about lending at the start of a recession or downward market; if a mortgage company is lending on a property valued at £500,000 today, but the forecast is for prices to fall in the next few years, the mortgage company risks not receiving full repayment of their loan if the property is worth £450,000 a few years later. Or as time goes on, where a mortgage lender might have viewed an issue or quirk with a property as a small risk, their criteria has changed to consider the risk as being more serious.

And of course a mortgage company might refuse to offer a mortgage to a prospective buyer because of any of the points above (short lease, absent freeholder, excessively high service charge, building/fire safety risks) as well as other risk factors. For example, if a flat is above a certain type of commercial premises; flats above laundrettes / dry cleaners and restaurants / takeaway premises are typically considered risky for mortgage companies.

You should also take into consideration any changes you have made to your flat that require consent from the freeholder. For example, if you own a top floor flat and have converted the loft space into an additional bedroom, even if the work has been approved by building control, if you don’t have consent from the freeholder you might be in breach of your lease, which can result in difficulty selling your flat.

TIP: For some issues or legal defects within a lease that might not be easy to resolve quickly, it might be possible to obtain an indemnity insurance policy. It is important to note that indemnity insurance does not cover costs to repair, replace or fix the problem but does potentially cover against an legal bill in the future.

The sale (transfer of ownership) for property and land in England & Wales follows a formal process; the official records of ownership are kept and managed by HM Land Registry and it is the job of a conveyancing solicitor to submit details of the change of ownership to HM Land Registry. In this section we summarise the documents that a conveyancing solicitor in England & Wales will need to review and process before they reach the final stage of submitting a change of legal ownership to the official records at HM Land Registry. And in the case of selling a leasehold flat, the conveyancing solicitor will also need to satisfy certain requirements of the freeholder.

If you are selling a leasehold flat, there is no expectation that you should know about the process, or the forms required, but it can be useful to have some understanding in case you find yourself needing to chase up your solicitor.

🔲 Selling a leasehold flat by auction – preparation is important

One of the key things that sets an auction sale apart from private treaty (estate agency) sale, is that all legal documents are prepared upfront and made available to prospective buyers BEFORE they place their offer (or bid). These documents take the form of the auction legal pack. Auction sales are legally binding, so the buyer carries out their research and reads the legal pack before they bid.

The sale of a leasehold flat requires all the same documents that are needed for the sale of a freehold property, with the addition of:

Information provided by the leaseholder which takes the form of the TA7 form also known as the leasehold information form.

Information provided by the freeholder (or their managing agent) which takes the form of the LPE1 and LPE2 forms (LPE is an initialism of Leaseholder Property Enquiries) which form the management information pack, also known as the leaseholder information pack.

A list of documents, including the leasehold forms mentioned above, are summarised below.

Proof of ownership

You will need to provide your solicitor with identification documents to prove you are the owner of the leasehold flat. These documents will need to match the name stated on the title document kept by Land Registry. Identification documents will typically include photo ID (e.g. a current passport or driving licence) plus 2 forms of proof of address e.g. utility bills or bank statements. Your solicitor will let you know exactly what documents are required and once received they will verify them before proceeding with any further legal work.

If you are not the owner of the property but you do have authority to sell the flat, you will need to provide supporting documents e.g. if you are the executor for an estate you will need to provide the grant of probate or letters of administration.

Title register, plan and lease

When selling a leasehold flat, one of the first things your solicitor will do is download the “official copies” from HM Land Registry. There will typically be 3 documents; title register, title plan and the lease. Your solicitor will check that your name matches the name on the title register, they will look at any charges (e.g mortgage) that will need to be settled and of course check the time remaining on the lease.

Although it’s possible for you to obtain a copy of the title register and plan from the Land Registry website yourself, if you want a copy of the lease you will need to apply in writing to Land Registry. It’s usually quicker and easier to leave that to your solicitor, as they will have access to Land Registry eservices and can download the file online.

The title register is sometimes referred to as a short-version of the lease. The title register has some salient information, but the full lease document is typically at least 10 pages long, setting out in detail the rights, regulations and obligations of the parties involved in the lease.

For more information about what’s typically included in a lease, it’s worthwhile looking at the understanding your lease page on the Leaseholder Advisory service website.

Energy Performance Certificate (EPC)

The EPC shows prospective buyers how energy efficient your leasehold flat is; giving it a rating from A (very efficient) to G (inefficient). The certificate provides an estimate of the cost to heat and light your flat, along with recommendations to improve the rating.

You need to make sure you have instructed an EPC inspection before commencing any sales and marketing activity. EPC’s are valid for 10 years from the date of issue, so it’s worth checking to see if you already have a valid EPC for your flat by using the governments find an energy certificate lookup.

Gas and Electrical Safety Certificate)

If you are selling a vacant leasehold flat there is no requirement for you to provide a gas safety certificate or electrical safety certificate. However, if you do have either of the certificates available it gan be a good idea to provide them to your solicitor as it will give prospective buyers confidence that the gas and electrics are in working order and safe.

The law if different for tenanted properties. If you are selling a tenanted flat you must have a valid electrical safety certificate in place. And if your flat has a gas cooker or gas heating there must be a valid gas safety certificate in place too.

FENSA Certificate

The Fenestration Self-Assessment Scheme (FENSA) was set up in April 2002 to make sure construction companies met building regulations for door and window installations.

A prospective buyers mortgage lender will request FENSA certificate for any replacement doors or windows that have been fitted at your flat. If you are selling your leasehold flat to a mortgage buyer and you (or the management company) do not have a FENSA certificate, your solicitor may be able to get indemnity insurance, which will usually satisfy the mortgage lender.

If you are selling your leasehold flat by auction, you don’t need to include a FENSA certificate in the legal pack. But it can be a good idea to include the FENSA certificate if you have one.

Property information form (TA6)

The TA6 (property information form) is one of three “transaction” information forms that leaseholders will need to complete when selling their flat. The other two forms are the TA7 (leasehold information form) and the TA10 (fittings and contents form). The forms are provided by the seller’s solicitor, for the seller to complete. The seller should complete the forms to the best of their ability; it is important to be truthful when completing the forms. Although the proverb “buyer beware” does to some extent apply when selling a property by auction, it is against the law for the seller to provide misleading information when completing these forms.

You might describe the TA6 form as a property information questionnaire. The form is used for both freehold and leasehold properties, so there will be sections of the form (e.g. boundaries) that may not be relevant to the sale of a leasehold flat. Other sections of the form include: disputes and complaints (i.e. with neighbours or nearby), notices or proposals, alterations and building control, guarantees and warranties, insurance, environmental matters (e.g. flooding and Japanese knotweed), rights and informal arrangements (e.g. rights of way), parking, charges, occupiers, services, connection to utilities (i.e. details of the water, gas and electricity supplier) and transaction information (e.g. move dates).

We’re sometimes asked whether it’s okay to sell a property by auction without completing some sections of the TA6 form, or not completing the form whatsoever. For example, if the seller is aware of Japanese knotweed on or near the property, can they just leave this section blank. The short answer is that you must disclose everything you are aware of. But there are sometimes situations where a property can legitimately be sold as seen, for example when when the seller as acting in a position as an executor, or with power of attorney.*

Some of the sellers we talk to are surprised to know they must disclose issues when selling a property by auction, thinking that a problem such as a noisy / anti-social neighbour can be swept under the carpet and believing auction is a quick fix for selling a problem property. In some ways they’re right, but for the wrong reason. The real benefit of selling a “problem” property through auction is that prospective buyers are filtered out before they bid; say if 10 prospective buyers are interested in the property. And after reading the TA6 only 3 buyers are still in the running, that’s still 3 buyers competing against each other on auction day, for a legally binding sale. Whereas with a private treaty (estate agency) sale, a property goes “under offer” when one (and only one) prospective buyers offer is accepted. The other 9 prospective buyers are turned away! That one prospective buyer might not have inspected the TA6 yet. And even if they have read and understood the TA6, it might be many months later that they change their mind, and instead decide to pursue the purchase of a similar property down the road, without a noisy neighbour. Leaving the seller having to find another buyer and start the entire conveyancing process from square one. In short, private treaty sales over-protect the buyer, at the expense of the seller.

* In the case of a probate or power of attorney sale, the seller might have limited information about the property and their solicitor might suggest the property is “sold as seen.” It’s quite common to see properties “sold as seen” at auction, but it’s important to point out that if the seller does have any knowledge of issues or disputes, they must be disclosed to prospective buyers whether they are selling privately, through an estate agent, or by auction.

Leasehold information form (TA7)

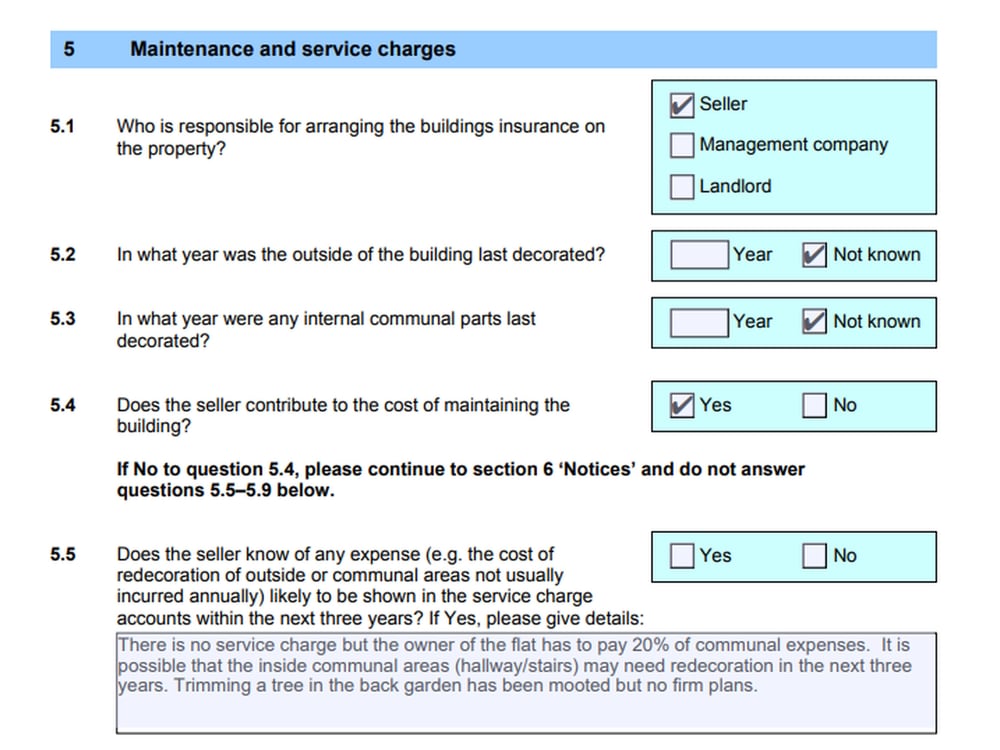

When selling your leasehold flat, another form your solicitor will ask you to complete is the TA7 (Leasehold Information Form), which you could describe as an extension of the TA6, but with questions that are specific to leasehold properties.

The TA7 asks the seller to provide information about the service charge and ground rent payments, along with supporting documents (copies of ground rent and service charge statements for the past 3 years). Other documents requested are copies of the lease and supplemental deeds – if you have originals, keep them safe and pass copies on to your solicitor. Most of the time a solicitor will be able to obtain copies from the Land Registry anyway.

Another section on the TA7 form asks the seller to provide details of who is responsible for insuring and managing the building, requesting contact details for the landlord (freeholder) and the managing agent, if there is one. The seller is also asked to provide approximate dates of when the building and internal areas were last decorated.

Example of questions asked on a TA7 – leasehold information form

Notices from the landlord about their intention to sell the building, and any notices about the condition, repair or maintenance of the building should also be documented.

The seller should also provide details of any alterations they have made since the lease was originally granted and whether consent was obtained from the landlord.

A section on “enfranchisement” which is the is the right of a tenant to purchase the freehold from their landlord and the right of the tenant to extend the term of the lease, should also be completed by the seller.

Leasehold pack (LPE1) and associated documents / management pack

LPE stands for Leaseholder Property Enquiries. The LPE1 is a form completed by the freeholder or their management agent (or the resident’s / tenant’s Association). Sometimes the LPE1 is referred to as the leaseholder pack or management information pack.

The LPE1 form itself has 9 sections.

1. Contact information for the freeholder and managing agent – also sets out details of who is responsible for matters like the collection ground rent and service charge.

2. Transfer and registration – the procedures and forms to be completed for the new owner to be a registered as a leaseholder.

3. Ground rent – the amount of ground rent payable and whether payment is up to date.

4. Service charge – the amount of service charge payable, whether payment is up to date and if there is expected to be a change to the service charge amount in the future.

5. Buildings insurance – insurance premium for the building and whether there have been any claims, or expected to be any claims.

6. Disputes and enfranchisement – sets out whether there any ongoing forfeiture

proceedings in relation to the property, or if there are any lease enfranchisement / lease extensions in progress.

7. General – information about how many flats there are in the building and if they are leased on similar terms.

8. Required documents – a checklist of documents to be included along with the LPE1 form itself. Documents such as: the last 3 years published service charge accounts, deeds of variation, licence to assign, insurance policies, asbestos survey, fire risk assessment etc.

9. Other useful information about the property – any other remarks to be made by the freeholder or managing agent.

The completed LPE1 form together with the requested documents combines to form the management pack.

And the LPE2 form contains information for the buyer relating to their key financial responsibilities when they take on the property, specifically: the costs associated with the purchase, regular payments during ownership and any additional payments that are planned.

Frequently asked question: Is an LPE1 required for auction?

We sometimes receive enquiries from leasehold flat owners who have not been able to obtain an LPE1 from the freeholder or their managing agent. In some cases it is possible to sell a leasehold flat at auction without an LPE1, but we always recommend that as much information as possible is included in the auction legal pack. In fact, some of the documents referred to in the LPE1, specifically the Deed of Covenant or Licence to Assign might be an essential requirement for the sale of your leasehold flat. Your solicitor will need to review the lease to confirm if a Deed of Covenant or Licence to Assign is needed.

Memorandum of sale

The memorandum of sale is only prepared when you have secured a buyer; for an estate agency sale this will be when you have accepted an offer from a prospective buyer, and for auction the memorandum of sale is prepared after the fall of the hammer, when the sale is legally binding. It’s a summary of the proposed transaction, giving solicitors the information they need to commence their work. It shows the names of the buyer, the seller and their respective solicitors contact details. Details of the sale price, the proposed exchange and completion date, and any other information that solicitors might need. The memorandum of sale is usually prepared by an estate agent or auctioneer.

Why sell by auction?

✔ Sell to the highest bidder

✔ Sales don’t fall through

✔ Sell leasehold flat quickly

Selling by auction makes a refreshing change, there are no protracted negotiations or sales falling through. With an unconditional auction sale the property is sold to the highest bidder and the sale is legally binding. There is no opportunity for the buyer to reduce their offer or back out of the sale.

Guide to selling a house by auction

Explains the stages involved in an auction sale. With information about auction sale costs, timescales and the process for selling at auction.

Carry out improvements before selling?

When selling a property in need of improvement, should I spend money on refurbishment works? Or leave the property as is, and let the new owner take care of improvements?

Poor condition property: Auction VS Estate Agent

The private treaty method of sale isn’t suited to some types of property – it’s inefficient and potentially open to abuse.

Selling a house in poor condition

The rules of an auction sale mean that buyers must compete to purchase a property. And the highest bidders offer is legally binding – there is no opportunity for them to reduce their offer.

Check before you sign

Looking for an unconditional legally binding sale? Before committing to sell your property at auction, check to see if the auctioneers contract is for an unconditional sale or a conditional sale.