Selling a Short Lease Flat?

Request a free & no-obligation auction sale price estimate

- Cost effective

No upfront fee & sell for free options - Quick

Sell your property in as little as 28 days - Secure & reliable

Legally binding sale on auction day - Fair & transparent

Sold to the highest bidder

For your peace of mind we are a member of The Property Ombudsman

Selling by auction is quick and easy. Request a no-obligation auction sale estimate for your short lease flat.

- Reliable

- Fast

- Secure

Interested to learn more about the easy and efficient process of selling your property by auction?

Talk to our team on 0800 862 0206

Sometimes it can be easier and more cost-effective to sell a property with a short lease, as is. Rather than paying to extend the lease before selling. Short lease properties often achieve higher than expected sale prices at public auction.

This article is designed to provide information about selling short lease properties (i.e. where a lease is 80 years or less). It also highlights the differences between selling a short lease in London versus the rest of the UK. The article also provides an update on the Leasehold and Freehold Reform Act 2024 (LAFRA).

Last updated by Mark Grantham on 12th February 2025

Jump to section: Selling a short lease flat at auction

Leases originate from a time when large buildings in city centres were divided into smaller units to cater for the increased demand for living accommodation – these units take the form of flats or apartments, which are held on leases.

From a legal perspective, leases are effectively just contracts granting temporary ownership of a property, they have an end date and there are rules for both the lessee and the lessor. In practice there’s no reason why leases should exist in the way they do; they could be far simpler and fairer on the lessee. In their current form they’re arguably biased towards the lessor (the land owner) as an opportunity to make money.

The law on leases hasn’t changed much over time, even new build flats (and sometimes even houses) are sold as leases with the same legal format as those leases granted over a hundred years ago. But things are changing, there is growing pressure from consumers for developers to offer a fairer deal on leases and changes to the law now make it easier for lessees to buy into the freehold and to manage the property themselves.

Owning the lease of a flat is different from owning a freehold; the lessee has obligations to pay the lessor (also known as a landlord or freeholder) a ground rent and service charge for maintenance of the common parts of the building. There may also be restrictions on what the lessee can do at the property – for example some leases prevent the lessee from being able to sublet (rent) the property, or there may be limitations on keeping pets. These rules are typically in place for the benefit of other lessees in the same building.

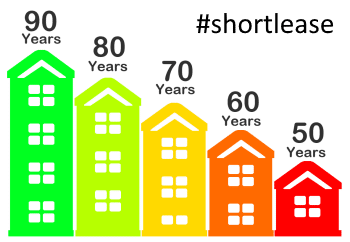

Leases are just a temporary form of ownership – they’re issued with a limited term of 99 or 125 years. Although more recently some leases are issued on 999 years leases, which are referred to as virtual freeholds. As time goes by the term of the lease diminishes – if you bought a flat with a 99 year lease 30 years ago, there would now be 69 years remaining – and this is important, because short leases are worth less than longer leases.

The value of a flat decreases as the lease term decreases below 80 years. If the lease for your flat is 80 years or less and you’re considering selling then you should consider exercising your right to extend your lease if you want to achieve a good sale price. Recent legal changes mean the owner of a short lease flat can extend thier lease at any time, they no longer have to own the property for 2 years before they have the right to extend the lease.

When selling a flat with a short lease, rather than paying to extend the lease before the sale, it’s more common to assign the right to extend the lease to the new buyer. There are three ways to do this:

Selling a Short Lease Flat: Option A – As from January 2025, leaseholders are no longer required to own a property for 2 years before gaining the right to extend their lease. Property commentators refer to this change as the “scrapping of the two-year rule”. As a result, a short lease flat can be sold “as is”. However, some buyers may have concerns if the lease extension process has not started – is the freeholder accessible to serve a lease extension notice to? Can they be confident that the lease can be extended without complications? This is where option B (detailed below) can provide prospective buyers with added reassurance.

Selling a Short Lease Flat: Option B – This quick and low-cost route is often the preferred method when selling a short lease flat by auction. The current owner of the lease agrees to serve a Section 42 Notice to the landlord/freeholder to acquire a lease extension and to assign the benefit of the Notice to the buyer upon completion. As long as there aren’t too many complications an experienced solicitor will charge about £500 for serving notice to the freeholder – that’s a small price to pay, as the benefit will greatly assist the saleability. The new buyer will be able to resume the lease extension process immediately after their purchase.

Selling a Short Lease Flat: Option C – Some buyers, particularly those purchasing with a mortgage may find option A and B too uncertain because the lease extension premium (the cost to extend the lease) has not been agreed by the freeholder. This longer and more expensive route involves the seller obtaining a professional valuation to determine the premium payable to the freeholder for a lease extension of 90 years added to the current unexpired term. With the formal lease extension route, the leaseholder serves a Section 42 Notice to the freeholder, with a proposed premium to extend the lease, and the freeholder responds with a counter-notice (Section 45 Notice) with a counter offer.

Note with options B and C, the freeholder can request a deposit equal to 10% of the leaseholders proposed premium. Failure to pay the deposit may result in the Section 42 Notice being invalid.

At long last, there is a now a requirement for estate agents to disclose “material information” as early in the sale process as possible. You may have noticed the property portals (like Rightmove and Zoopla) now state whether a property is leasehold or freehold. It’s a small change, but it’s a move in the right direction. We encourage property sellers to voluntarily disclose as much information about their property as early in the sale process as possible, including the time remaining on the lease.

Providing upfront information to prospective buyers helps save time for everyone. It means the seller doesn’t have to wait for the buyer’s solicitor to discover the facts in the late stages of the conveyancing process, and risk the sale falling through, sometimes months after a sale was initially agreed.

Advertising a property as “short lease” or “45 years remaining on the lease” is a good starting point. Prospective purchasers who know the implications of buying a short lease flat will skip that listing and continue their search elsewhere. And it might prompt other prospective buyers to ask questions, potentially filtering out offers and preventing any “false starts”.

This is all good. But it’s only the start of the sale process. Any offers received through an estate agency sale are still subject to contract and management enquiries. There’s a lot of work to do before legal exchange of contracts. Even with the best will in the world, obtaining a complete set of leasehold information and replies to enquiries can take weeks or months. Encouraging solicitors to work quickly, chasing the freeholder and responding to enquiries promptly can all help. But even after all that work, the prospective buyer is quite within their rights to withdraw from their purchase without giving any particular reason. The buyer may have simply had a change of heart.

With an auction sale, the process is very different; prospective buyers are provided with all the information about a property upfront (including a copy of the lease) in the form of an auction legal pack. It’s up to the buyer to read the legal pack and carry out their research before they place their bid. There’s no backing out. Auction buyers are bidding to buy – committing to a legally binding contract. On auction day, the buyer legally exchanges contracts and pays their 10% deposit, for completion of sale on a set date in the future (usually 28 days). And that’s why short lease flats are particularly well suited to sale by auction, cutting through the often long and frustrating process of lease extension questions, protracted management enquiries and of course prospective buyers getting cold feet at the last hurdle!

The Leasehold and Freehold Reform Act 2024 (LAFRA) is a significant piece of legislation in England and Wales that aims to make it more affordable and straightforward for leaseholders to extend their leases or purchase their freeholds. Key provisions of LAFRA include:

- Extended Lease Terms: Leaseholders can now extend their leases by an additional 990 years at a nominal ‘peppercorn’ rent, providing long-term security.

- Abolition of the Two-Year Ownership Requirement: Previously, leaseholders had to own their property for at least two years before initiating a lease extension or freehold purchase. This requirement has been removed, allowing leaseholders to act immediately upon acquiring their property.

- Elimination of Marriage Value: The concept of ‘marriage value,’ which often increased costs for leaseholders with leases under 80 years, has been abolished, potentially reducing the premiums payable for lease extensions.

- Increased Non-Residential Threshold: The permissible non-residential space in a building has been increased from 25% to 50%, enabling more mixed-use buildings to qualify for enfranchisement or the Right to Manage.

- Greater level of transparency over service charges; making freeholders or managing agents issue bills in a clear, standardised format that are easier for leaseholders to challenge.

- Making it easier and cheaper for leaseholders to take over the management of their flats.

- Scrapping the presumption that leaseholders pay their freeholders legal costs when challenging poor practice.

- Banning excessive and opaque buildings insurance commissions for freeholders and managing agents.

As of January 31, 2025, the removal of the two-year ownership requirement is in effect. Other provisions will be implemented as the necessary secondary legislation is enacted. Leaseholders and landlords should stay informed about these changes, as they significantly impact property rights and responsibilities.

Need help deciding? If you’re not sure what type of auction service best suits your requirements, please contact us on 0800 862 0206.

Please note: The article is intended as a helpful guide and is limited to providing general information and tips about selling a house by auction. It should not be treated as legal advice. We recommend checking with your solicitor before making any decisions. And we’re happy to help if you require any general information about selling a property by auction.

Although the leasehold reforms are expected to have an overall positive effect when selling a short lease flat. The decision to sell now, or wait, will depend upon your individual circumstances. For example, if you need to raise funds to repay your mortgage very soon, it might not be sensible to wait. It is advisable to speak with your solicitor regarding your individual situation.

Need help selling a short lease flat? Call 0800 862 0206 or send us an enquiry online.

Selling a short lease flat?

Need help choosing a property auctioneer? Please contact us on 0800 862 0206 or send us an enquiry online.