Selling a property with structural problems?

- Cost effective

No upfront fee & sell for free options - Quick

Sell your home by auction in as little as 28 days - Secure & reliable

Legally binding sale on auction day - Fair & transparent

Sold to the highest bidder

For your peace of mind we are a member of The Property Ombudsman

Selling by auction is quick and easy. Request a no-obligation auction sale estimate for your house or flat.

- Reliable

- Fast

- Secure

Interested to learn more about the easy and efficient process of selling your property by auction?

Talk to our team on 0800 862 0206

Selling a Property with Structural Issues: Comprehensive Guide

Selling a property with structural issues in the UK presents unique challenges. Structural problems can deter buyers, lower property values, and make mortgage approvals difficult. However, with the right approach, it is still possible to sell a home with structural defects.

Foundations

Walls

Subsidence

Underpinned

Roof

Older Properties

Value

Mortgage

Insurance

Hidden Defects

Legal Risks

Selling

Auction

Fix Before Selling

Sell With Issues

Leasehold Flats

FAQ’s

This guide explores everything you need to know, from identifying structural issues to understanding legal obligations and the best ways to market a property with defects.

What Types of Structural Issues Are There?

Structural problems vary in severity, and it is essential to identify them early. Below is a comprehensive list of common structural issues and how to spot them:

1. Foundation Issues

- Subsidence – Ground beneath the house sinks, causing structural instability.

- Heave – The opposite of subsidence; the ground swells, pushing up the foundation.

- Settlement – Minor sinking of a building, often due to new construction settling.

- Cracked Foundation – Visible cracks in concrete or brick foundations.

- Underpinning Needed – When foundations need reinforcement due to instability.

🛠 Signs: Cracks in walls, uneven floors, doors/windows sticking, visible foundation cracks.

2. Wall & Structural Frame Issues

- Cracks in Load-Bearing Walls – Can indicate foundation movement or structural weakness.

- Bow or Leaning Walls – Often due to soil pressure or poor construction.

- Wall Tie Failure – Weak wall ties in cavity walls cause the outer wall to bulge.

- Brickwork Deterioration – Crumbling bricks (spalling), missing mortar, or frost damage.

🛠 Signs: Large diagonal cracks, visible bulging walls, deteriorating brickwork.

3. Roof Structural Issues

- Sagging Roof – Often due to weakened rafters, poor construction, or foundation movement.

- Roof Leaks – Can lead to timber rot, mold, and water damage.

- Missing or Damaged Roof Trusses – Reduces structural stability.

- Poor Drainage Leading to Rot – Water pooling can weaken structural supports.

🛠 Signs: Uneven or drooping roofline, leaks, visible wood rot.

4. Floor Issues

- Uneven or Sloping Floors – Could be due to foundation shifts or subfloor deterioration.

- Wood Rot in Floor Joists – Often caused by dampness or termite damage.

- Weak Floor Support Beams – Can lead to bouncing or sagging floors.

🛠 Signs: Floors that feel unstable, creaking excessively, gaps between floorboards.

5. Damp & Water Damage-Related Structural Issues

- Rising Damp – Water from the ground rises into walls due to poor damp proofing.

- Penetrating Damp – Water seeps through walls, often due to leaks or poor drainage.

- Condensation Damage – Can weaken internal walls and lead to mold growth.

- Timber Decay (Dry Rot / Wet Rot) – Weakens floorboards, joists, and roof structures.

🛠 Signs: Mold growth, peeling paint, damp patches, musty smell.

6. Lintel & Beam Failures

- Cracked or Sagging Lintels – Load-bearing supports above doors and windows fail.

- Failing Steel Beams (RSJs) – Used in extensions but can corrode if poorly installed.

- Wooden Beam Decay – Common in older homes with timber-framed structures.

🛠 Signs: Gaps above windows, sagging door frames, cracks around openings.

7. Soil & Drainage-Related Structural Problems

- Tree Root Damage – Roots can cause soil shrinkage or push against foundations.

- Poor Drainage Leading to Erosion – Excess water can wash away foundation soil.

- Expansive Clay Soil – Some soils expand and contract with moisture, causing movement.

🛠 Signs: Cracks in the ground near foundations, sudden movement in property.

8. Structural Movement & Instability

- Lateral Movement – When walls move sideways due to external pressure.

- Poor Construction or Defective Materials – Substandard building work weakens structures.

- Impact Damage – Structural weakening due to accidents (e.g., vehicle collision, storms).

🛠 Signs: Warped walls, unexpected cracks, structural instability after extreme weather.

9. Other Issues

- Cladding & Fire Safety Issues – Particularly relevant to leasehold flats, some cladding materials have been deemed unsafe, requiring costly remediation.

- Poor Construction or Defective Materials – Some homes have inherent weaknesses due to poor-quality building materials or flawed construction methods.

Identifying these issues early can help determine the best course of action for selling a property with structural concerns.

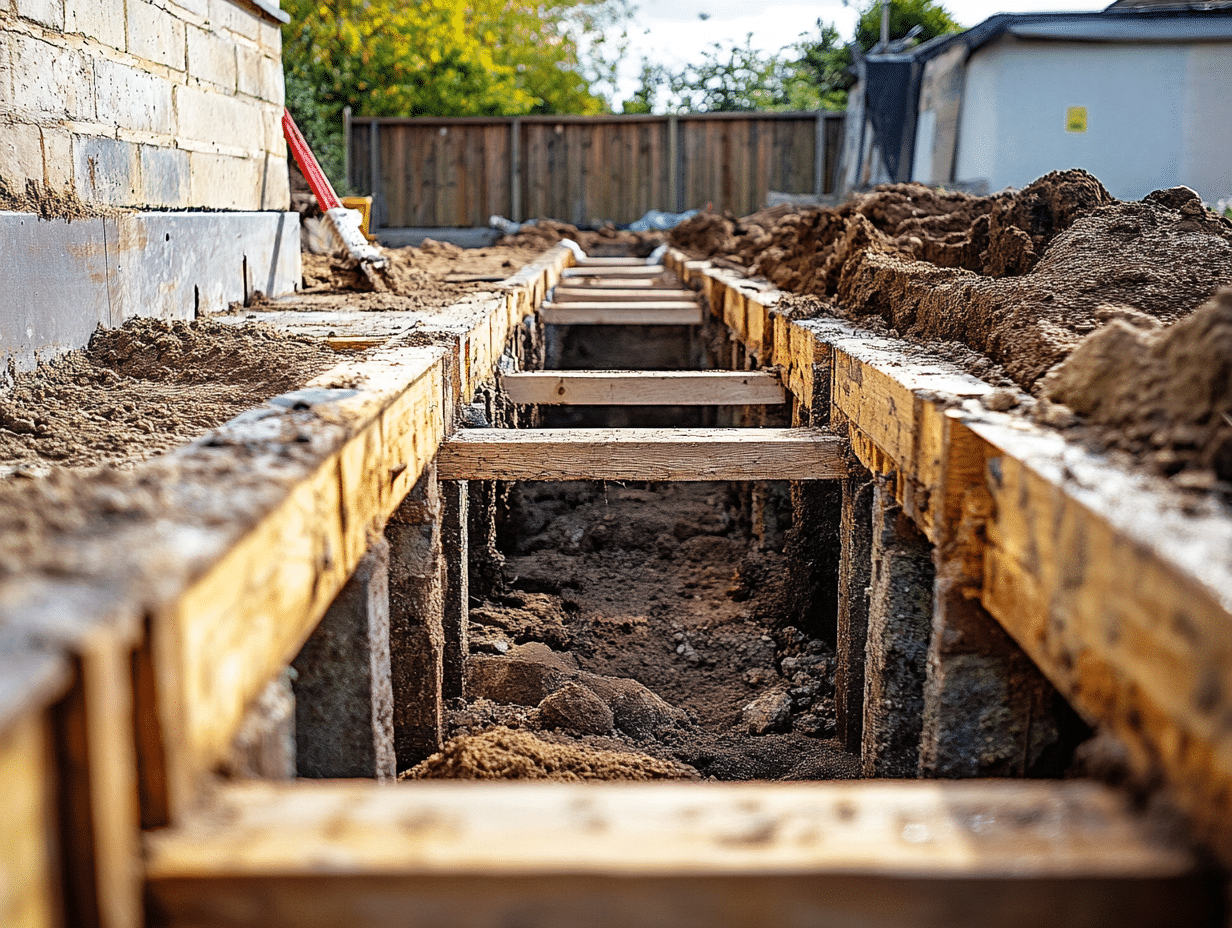

Foundation Issues and Selling a House That Has Been Underpinned

Foundation problems, particularly subsidence, can significantly impact the ability to sell a house. Underpinning is a method used to stabilise foundations, but it can be viewed negatively by buyers and lenders. Understanding how underpinning affects the sale process and what steps to take can make a significant difference.

What is Underpinning?

Underpinning is a structural repair process used to strengthen a building’s foundation when it has become unstable. This is often required when a property has suffered from subsidence, where the ground beneath shifts and weakens support.

How Underpinning Affects Property Sales

- Buyer Confidence – Many buyers may be wary of purchasing an underpinned property, fearing further issues or difficulty obtaining insurance and a mortgage.

- Mortgage Lenders’ Concerns – Some lenders refuse to finance underpinned properties unless a structural engineer provides a stability certificate.

- Insurance Challenges – Home insurance for an underpinned house may be more expensive or require specialist policies.

Key Considerations When Selling an Underpinned House

- Full Disclosure – Buyers and mortgage lenders need to know that underpinning has been carried out. Not disclosing this can lead to legal repercussions.

- Certification & Documentation – Structural engineer reports, building control approval, and details of remedial work should be readily available to reassure buyers.

- Insurance History – Buyers may request evidence that the property has been continuously insured post-underpinning.

- Value Impact – Underpinning may reduce the property’s value but can make it more marketable than an uncorrected subsidence issue.

- Targeting the Right Buyers – Cash buyers and investors may be more inclined to purchase an underpinned property, especially if documentation proves stability.

Tips for Selling a House That Has Been Underpinned

- Get a Structural Engineer’s Report – A recent assessment can provide confidence in the property’s stability.

- Ensure Transparency in Marketing – Be upfront about underpinning in property listings to attract serious buyers.

- Highlight the Benefits – Explain that underpinning has resolved previous subsidence issues, making the house more stable.

- Consider a Pre-Sale Insurance Offer – Securing a quote for home insurance in advance can reassure potential buyers.

- Set a Realistic Price – Expect valuation adjustments due to past subsidence history, but highlight stability improvements.

Selling a house with foundation issues requires strategic planning, but with the right documentation and approach, a successful sale is possible.

Short on time?

If you don’t have the time to read this article in full, we can come back to you with a free auction appraisal, to help you decide if selling by auction is a good option for you. Request a free estimate and we’ll come back to you.

Do Cracks in Walls Mean a Property Has Structural Issues?

Not all cracks indicate severe structural problems, but they can be a sign of underlying issues that require further investigation. Understanding the types of cracks, their locations, and possible causes can help determine whether they are a serious concern.

When to Be Concerned

- Diagonal cracks wider than 5mm, particularly near doors and windows, may indicate subsidence or foundation movement.

- Stair-step cracks in brickwork, often a sign of differential settlement or foundation shifting.

- Cracks appearing suddenly or worsening over time could suggest active structural movement.

- Gaps forming between walls and ceilings/floors may be a sign that structural elements are pulling apart.

- Horizontal cracks in walls, particularly in load-bearing walls, can be a sign of significant structural stress.

- Multiple cracks in the same area can indicate ongoing movement, often requiring professional assessment.

When Cracks Are Not a Problem

- Hairline cracks due to plaster shrinkage are common and generally not structural concerns.

- Cracks in new buildings caused by normal settlement typically appear within the first few years and do not necessarily indicate structural issues.

- Seasonal movement cracks, which may appear and disappear with temperature or humidity changes, are usually harmless.

- Surface cracks in paint or plaster that do not penetrate into masonry or structural elements.

What to Do if Cracks Are Present?

If cracks appear concerning, it is advisable to:

- Consult a structural engineer for a professional assessment.

- Monitor cracks over time, using a crack gauge or taking photos to track changes.

- Check for other structural issues, such as sticking doors and windows, sloping floors, or bulging walls.

- Review property history for previous subsidence, underpinning, or repair work.

Identifying and addressing cracks early can help prevent costly repairs and reassure potential buyers when selling a property.

Subsidence: How It Affects Sale Price and Can You Sell As-Is?

Subsidence is a serious structural issue that can significantly affect a property’s market value and saleability. It occurs when the ground beneath a property shifts, causing the foundations to move and potentially leading to structural damage. This can make potential buyers and mortgage lenders wary of proceeding with a purchase.

How Subsidence Reduces Property Value

- Up to 20-25% reduction in market value due to repair costs, buyer hesitancy, and mortgage complications.

- Mortgage lenders may refuse to finance a property with ongoing subsidence issues or require substantial proof of remediation.

- Insurance premiums for affected homes are often higher, and some insurers may refuse to cover the property altogether.

- Surveyor red flags: If subsidence is identified in a homebuyer survey, buyers may demand further investigations or negotiate a lower price to compensate for potential repair costs.

Signs of Subsidence Buyers Should Look Out For

- Large diagonal cracks in walls, particularly near doors and windows.

- Doors and windows sticking due to frame distortion.

- Uneven or sloping floors, which indicate structural movement.

- Gaps forming between walls and ceilings or skirting boards.

- Sudden appearance of cracks in external brickwork or driveways.

Can You Sell a House with Subsidence?

Yes, but the process may require additional steps and considerations:

- Selling As-Is: You may need to target cash buyers or investors, as most mortgage lenders will be reluctant to finance the purchase of a property with unresolved subsidence.

- Carrying Out Repairs: Underpinning and structural repairs can restore value but require investment. If the property has been underpinned, ensure that you have documentation and certifications from a structural engineer to reassure potential buyers and lenders.

- Providing Documentation: A structural engineer’s report confirming the stability of the property post-repair can be crucial in securing a sale.

- Disclosing Subsidence History: Sellers are legally required to disclose any history of subsidence and remedial work undertaken in the TA6 Property Information Form.

- Negotiating on Price: Buyers will often use subsidence as leverage to reduce the asking price, factoring in potential repair costs and perceived risk.

While selling a house with subsidence can be challenging, a well-documented and transparent approach can improve buyer confidence and facilitate a successful sale.

Roof Sagging Issues and Impact on Sale Price

Roof sagging can be a serious structural concern, often arising from weakened support structures, prolonged water damage, or aging roofing materials. Buyers are often hesitant to purchase properties with sagging roofs due to the potential repair costs and associated risks.

Causes of Roof Sagging

- Water Damage – Prolonged exposure to moisture can weaken rafters and roof supports, leading to sagging.

- Aging Materials – Over time, roofing materials deteriorate, making them less effective in maintaining structural integrity.

- Poor Construction – If a roof was not properly designed or constructed, it may sag under its own weight.

- Heavy Load on Roof – Excessive snow accumulation, additional roofing layers, or unplanned structural loads can cause sagging.

- Foundation Movement – Shifts in the foundation can translate upward, affecting the roof’s alignment.

How Roof Sagging Affects Selling Price

- Minor sagging: If the issue is purely cosmetic or due to superficial aging, the impact on price may be minimal. A small discount or quick repair can restore buyer confidence.

- Moderate sagging: If repairs are necessary but not urgent, expect a 5-10% reduction in property value due to repair costs.

- Severe sagging: If the roof is structurally unsound and requires full replacement, it can result in a 15-20% reduction in sale price, depending on repair estimates and buyer negotiations.

Selling a House with Roof Sagging Issues

- Obtain a Roof Inspection Report – A professional assessment can reassure potential buyers about the extent of the issue.

- Offer Repair Quotes – Providing estimates from roofing specialists can help buyers understand the financial implications and avoid excessive price negotiations.

- Consider Repairing Before Selling – If the roof is severely damaged, fixing it beforehand can help secure a mortgage-backed buyer.

- Target Cash Buyers – If the sagging is significant and financing is difficult, cash buyers or investors may be more interested in purchasing the property as-is.

- Highlight Any Warranty or Insurance Coverage – If previous repairs were carried out with warranties, they may be transferable to the new owner, adding value to the sale.

Addressing roof sagging concerns proactively can help ensure a smoother sale process and minimise value depreciation.

Jump to section: Frequently Asked Questions

Can You Sell a House with Hidden Structural Defects?

Selling a house with hidden structural defects can be legally complex and financially risky. While it is possible to sell a property with such issues, sellers must be aware of their legal obligations and potential consequences.

Legal Responsibilities of the Seller

- Disclosure Obligations – Under UK law, sellers must disclose any known structural defects. Deliberately hiding issues can lead to legal repercussions.

- TA6 Property Information Form – This form, required in most property transactions, includes questions about known defects. Sellers must answer truthfully.

- Caveat Emptor (Buyer Beware) – Buyers are expected to conduct due diligence, but if a seller knowingly withholds important information, they may be liable for misrepresentation.

Risks of Selling Without Disclosing Defects

- Legal Action – A buyer may sue for misrepresentation if they discover hidden defects after purchase.

- Reduced Buyer Confidence – If defects are uncovered during a survey, buyers may withdraw from the sale or demand price reductions.

- Difficulty Securing a Sale – Mortgage lenders may refuse to finance a property with hidden structural defects, limiting the pool of potential buyers.

Best Practices for Selling a Property with Structural Defects

- Obtain a Structural Survey – A professional assessment can clarify the severity of issues and help set a realistic price.

- Be Transparent with Buyers – Disclosing defects upfront can prevent legal disputes and maintain trust.

- Consider Repairing Major Issues – Fixing significant structural problems can increase marketability and sale price.

- Target the Right Buyers – Investors and cash buyers may be more willing to purchase a property with defects, especially if they plan to renovate.

- Work with a Specialist Agent – Some estate agents specialise in selling properties with structural issues and can help find suitable buyers.

While selling a house with hidden structural defects is possible, honesty and transparency are crucial to avoiding legal trouble and ensuring a smooth transaction.

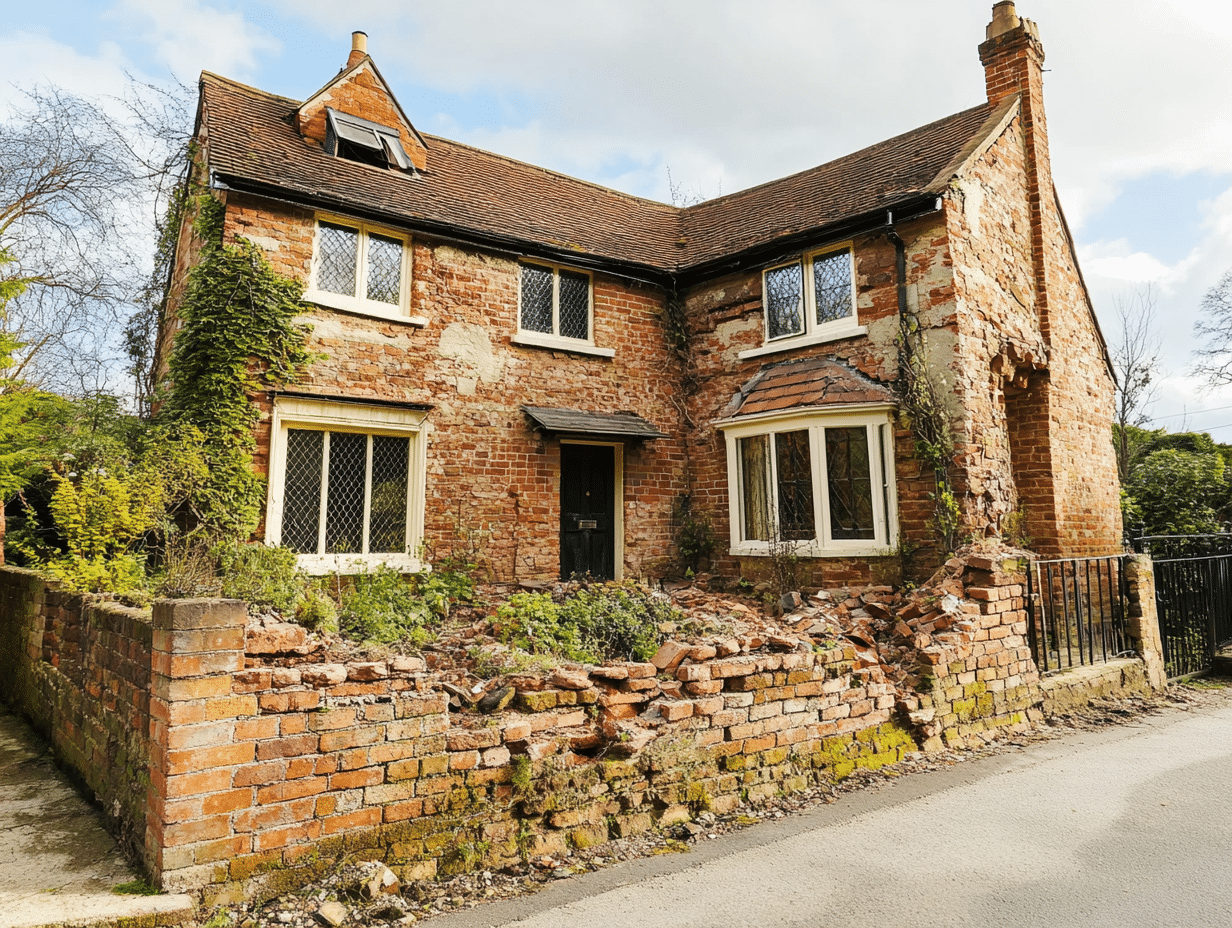

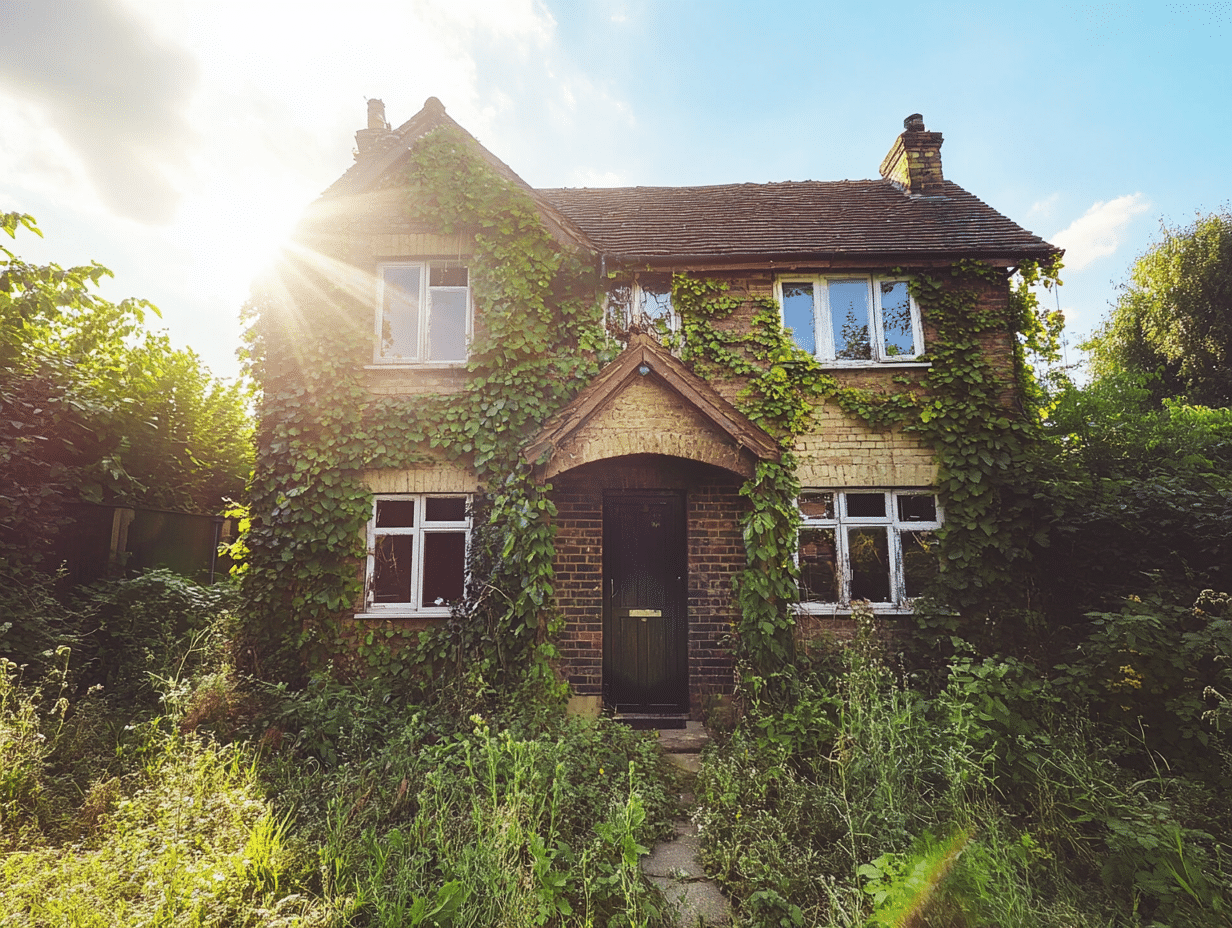

Are Older Properties More Likely to Have Structural Issues?

Yes, older properties (especially pre-1940s homes) are more likely to have structural issues due to the materials and construction methods used at the time. Over the decades, factors such as wear and tear, environmental exposure, and outdated building regulations contribute to their susceptibility to defects.

Common Structural Issues in Older Properties

- Weak Foundations – Many older homes were built with shallower foundations that may not meet modern standards, making them more vulnerable to subsidence and movement.

- Timber Decay – Wooden structural elements, including beams and floor joists, can suffer from dry rot, wet rot, or woodworm infestation over time.

- Outdated Building Materials – Older properties often contain materials such as lime-based mortar, single-brick walls, or lath and plaster, which are less durable than modern alternatives.

- Poor Insulation and Ventilation – Many older homes were not designed with modern insulation, leading to condensation, damp problems, and potential structural deterioration.

- Roof Deterioration – Traditional slate or clay tile roofs may become weak over time, especially if not regularly maintained.

- Unstable Chimneys – Brickwork on chimneys can erode due to exposure to the elements, posing structural risks.

- Corroded Metal Supports – Older homes with steel or iron structural reinforcements may suffer from corrosion, reducing their integrity.

- Subsidence and Settlement – Some older homes experience subsidence due to shifts in the soil or the natural settling of the structure over time.

Do All Older Homes Have Structural Issues?

Not necessarily. Well-maintained older properties can remain structurally sound for centuries. Many historic buildings have been carefully preserved and upgraded to meet modern standards. Regular inspections and proper maintenance can significantly reduce the risk of severe structural problems.

What Can Buyers and Sellers Do?

- Obtain a Structural Survey – A full building survey is highly recommended for older properties to assess potential structural risks.

- Carry Out Preventative Maintenance – Regular inspections of roofs, foundations, and timber structures can prevent small issues from becoming major problems.

- Check for Past Renovations – Properties that have undergone structural improvements, such as underpinning or beam replacements, may be more stable than those with original features.

- Understand Building Regulations – Some older properties may require updates to comply with modern safety and structural regulations.

Older properties can be charming and full of character, but they require careful consideration when buying or selling, especially if structural issues are present.

Read our guide to selling an unmodernised property

Our guide is designed to assist homeowners in navigating the sale of an unmodernised house or flat in the UK.

Read more about selling an unmodernised house by auction.

Do Sellers Need to Disclose Structural Issues?

Yes, under Property Misrepresentation Law, sellers must disclose known defects. Failure to do so can lead to legal consequences if a buyer later discovers an issue that was intentionally withheld.

What Must Be Disclosed?

- Any past or present structural issues such as subsidence, roof sagging, or foundation movement.

- Previous repairs or underpinning work, even if completed to a high standard.

- Damp, rot, or mould issues that could indicate deeper structural concerns.

- Any insurance claims made due to structural damage.

- Survey findings that have highlighted potential structural defects.

Required Forms

- TA6 Property Information Form – This legally required form includes a section where sellers must disclose any known defects, disputes, or significant past repairs.

- Survey Reports – If a buyer requests them, any previous structural surveys should be provided to ensure transparency.

- Insurance and Warranty Documents – If any guarantees or warranties exist for past structural repairs, they should be made available to potential buyers.

Consequences of Non-Disclosure

- Legal Action – If a buyer finds significant hidden defects post-sale, they may sue for misrepresentation.

- Compensation Claims – Buyers may seek financial compensation for repair costs.

- Loss of Buyer Trust – If undisclosed issues surface during a survey, the buyer may withdraw, delaying the sale process.

Sellers are encouraged to be as transparent as possible to avoid legal repercussions and ensure a smoother transaction.

Legal Risks of Selling a Property with Structural Issues

Selling a property with structural issues carries several legal risks, particularly if full disclosure is not provided. The legal responsibilities of the seller, potential disputes, and buyer protection laws must be carefully considered to avoid complications.

Key Legal Risks

- Failure to Disclose Issues – Sellers are legally required to disclose any known structural problems. The TA6 Property Information Form must be completed honestly. Misrepresenting or concealing defects can lead to legal claims from buyers.

- Breach of Contract – If a seller knowingly provides false information or fails to disclose major structural problems, the buyer may claim misrepresentation and seek financial compensation or cancel the sale.

- Negligent Surveys – If a surveyor fails to identify significant structural issues, a buyer may take legal action against them for professional negligence.

- Insurance and Mortgage Implications – Buyers may struggle to secure financing or insurance if undisclosed structural defects are later discovered, leading to legal challenges against the seller.

- Claims for Compensation – If defects surface post-sale that were not disclosed, the buyer may seek legal recourse, including demanding that the seller cover repair costs or even rescind the transaction.

How to Minimise Legal Risks When Selling

- Full Disclosure – Always provide accurate information on known structural defects, repairs, and previous claims.

- Obtain Professional Reports – A structural survey or engineer’s report can help validate the condition of the property.

- Provide Relevant Documentation – This includes previous repair records, insurance claim history, and guarantees for past remedial work.

- Use a Knowledgeable Solicitor – A property solicitor with experience in structural issues can help navigate disclosure requirements and ensure legal compliance.

Being transparent about structural problems can help avoid legal disputes, maintain buyer trust, and ensure a smoother sales process.

Should You Fix Structural Problems Before Selling?

Deciding whether to fix structural problems before selling depends on several factors, including the severity of the issues, the cost of repairs, and the impact on the property’s value and marketability. Some sellers may benefit from making necessary repairs, while others may opt to sell the property as-is to cash buyers or investors.

Pros of Repairing Before Sale

- Increases Marketability – Buyers are more likely to be interested in a structurally sound property, making it easier to sell.

- Allows Mortgage Buyers to Purchase – Many lenders refuse to finance homes with unresolved structural problems, limiting the pool of potential buyers.

- Higher Sale Price – A repaired property can command a higher price compared to one with unresolved defects.

- Avoids Last-Minute Buyer Withdrawals – If issues arise during a survey, buyers may attempt to renegotiate or withdraw from the sale.

- Eases Negotiations – With repairs completed, buyers have fewer reasons to negotiate a lower price.

Cons of Repairing Before Sale

- Costly Upfront Repairs – Structural repairs can be expensive, and sellers may not want to invest heavily before selling.

- Potential Delays in Listing – Repair work can take weeks or months, delaying the sale process.

- No Guarantee of Full Return on Investment – While repairs can increase property value, the cost of work may not always be fully recouped in the sale price.

- Still May Require Price Reductions – Even after repairs, some buyers may still be hesitant and negotiate lower prices due to the property’s history of structural issues.

When Should You Fix Structural Problems?

- If the structural issue is minor and affordable to fix, such as small foundation cracks or a sagging lintel.

- If fixing the problem will significantly increase the property’s value and appeal to a larger audience, including mortgage buyers.

- If you want to avoid lengthy negotiations and potential sale fall-throughs due to buyer concerns.

- If the structural issue is severe enough that most buyers would struggle to obtain financing, making repairs a necessary step.

When Should You Sell As-Is?

- If the cost of repairs is too high and would not result in a proportionate increase in sale price.

- If you need a quick sale, and targeting cash buyers or investors is a viable option.

- If the buyer intends to redevelop or renovate the property and may prefer to handle repairs themselves.

Before deciding, it may be wise to obtain a structural survey to assess the extent of the damage and get estimates from contractors. Consulting with an experienced estate agent or property expert can help determine the best course of action based on market conditions and buyer demand.

How Much Do Structural Issues Affect Property Value?

Structural issues can significantly impact a property’s market value, with the extent of the reduction depending on the severity of the problem and whether remedial work has been undertaken.

Factors Influencing Value Reduction

- Minor Issues – Small cracks, non-structural damp, or slight roofing issues may lead to a 5-10% reduction in value if easily fixable.

- Moderate Structural Problems – Issues such as partial subsidence, underpinning history, or roof sagging can result in a 10-20% reduction in price.

- Major Structural Defects – Severe foundation movement, active subsidence, or extensive structural decay can lower the value by 20-30% or more, particularly if the property is deemed unmortgageable.

- Surveyor & Lender Perception – Mortgage lenders may refuse loans for properties with significant defects, further reducing buyer interest and limiting the market to cash buyers.

- Extent of Repairs Needed – If remedial work is extensive, buyers may demand substantial price reductions to cover the cost and perceived risk.

Market Considerations

- Properties with unresolved structural problems often attract investors and cash buyers rather than standard owner-occupiers.

- The local property market plays a role—structurally compromised homes in high-demand areas may still retain more value.

- Sellers can mitigate value loss by providing a structural engineer’s report, insurance documentation, and repair estimates to reassure potential buyers.

Impact of Repairs on Value

If structural repairs have been professionally completed and documented, the value reduction can be minimised. However, an underpinned or previously subsiding property may still be worth 5-10% less than a comparable home with no history of issues.

Understanding these factors can help sellers set realistic pricing expectations and navigate negotiations effectively when selling a home with structural concerns.

Can a House with Structural Issues Be Underpinned?

Yes, underpinning is a widely used method to stabilise a property’s foundations when structural issues arise due to subsidence, soil movement, or inadequate initial construction. Underpinning strengthens and reinforces the foundation, making the property more stable and potentially restoring its mortgage eligibility. However, the process can be costly and may impact the property’s value and desirability among buyers.

When is Underpinning Necessary?

- Subsidence – If the foundation is sinking due to soil movement, tree roots, or water erosion.

- Foundation Weakness – Older properties with shallow foundations may require underpinning to meet modern building standards.

- Structural Instability – Significant cracks in walls, sloping floors, or misaligned doors and windows could indicate foundation failure.

- Post-Renovation Support – If a property undergoes extensive renovations or extensions, underpinning may be required to support the new structure.

How Underpinning Affects Property Value and Saleability

- Improved Stability – A well-underpinned property can be more structurally sound than before the repairs.

- Buyer Hesitation – Some buyers may be wary of purchasing an underpinned home due to concerns about long-term stability.

- Lender Considerations – Mortgage providers may require a structural engineer’s report confirming that the underpinning has been successful before approving financing.

- Insurance Costs – Some insurance providers charge higher premiums or impose restrictions on underpinned properties.

Types of Underpinning

- Mass Concrete Underpinning – The most common method, where concrete is poured under the existing foundation in controlled phases.

- Mini-Piled Underpinning – Used in cases where deeper soil stabilisation is needed, often in areas with weak ground conditions.

- Beam and Base Underpinning – A reinforced concrete beam redistributes the foundation load over a larger area.

- Resin Injection Underpinning – A modern approach where expanding resin is injected into the soil to improve stability.

Selling an Underpinned Property

If underpinning has been carried out, sellers should:

- Obtain Documentation – Structural engineer reports, building control approval, and completion certificates should be readily available.

- Be Transparent with Buyers – Clearly disclose underpinning history and provide evidence of successful remediation.

- Highlight Stability Improvements – Underpinning can be framed as a proactive solution that has resolved previous structural concerns.

- Consult Estate Agents Specialising in Structural Issues – Some buyers, especially cash buyers and investors, may specifically seek underpinned properties as investment opportunities.

Although underpinning can restore a property’s structural integrity, it is crucial to manage buyer expectations and provide proper documentation to facilitate a smooth sale.

Can a House with Structural Issues Get a Mortgage?

Obtaining a mortgage for a house with structural issues can be challenging, but it is not impossible. The extent of the damage, the lender’s policies, and the availability of structural reports all play a role in determining whether a mortgage can be approved.

Factors That Influence Mortgage Approval

- Severity of the Structural Issues – Minor problems, such as hairline cracks or slight dampness, may not affect mortgage eligibility, while major concerns like subsidence, foundation movement, or roof sagging can make obtaining a mortgage difficult.

- Surveyor’s Report – Mortgage lenders will often require a structural survey or homebuyer’s report before making a decision.

- Remediation Work Completed – If structural repairs have been successfully completed with certification from a structural engineer, lenders may be more willing to approve a mortgage.

- Lender Policies – Some mortgage providers are stricter than others regarding structural issues. Specialist lenders may offer products for properties with defects but often at higher interest rates.

- Insurance Availability – If the property cannot be insured due to its condition, it may be deemed unsuitable for a mortgage.

Options If a House Fails to Qualify for a Mortgage

- Cash Buyers – If the property is deemed unmortgageable, cash buyers or investors may be the best option for a quick sale.

- Bridging Loans – Short-term loans can be used to finance the purchase of a structurally compromised property until repairs are made and a standard mortgage becomes available.

- Renovation Mortgages – Some lenders offer specialist mortgages that release funds in stages as structural repairs are completed.

- Underpinning and Certification – If the issue is subsidence-related, completing underpinning and obtaining a structural engineer’s report can improve mortgage prospects.

How to Improve Mortgage Eligibility for a Structurally Compromised Property

- Obtain a full structural survey and share it with lenders to provide clarity on the severity of the issue.

- Secure builder quotes and potential remedial work plans to show lenders the steps to resolve the problem.

- Look for specialist mortgage lenders that cater to non-standard properties.

- Ensure the property is insurable, as lenders often require proof of insurance before approving a mortgage.

While securing a mortgage for a property with structural issues can be difficult, taking proactive steps and exploring alternative financing options can increase the likelihood of success.

Insurance

It is possible to get insurance on a house with structural issues in the UK, but it can be more challenging and expensive than insuring a property in good condition. Here’s what you need to know:

1. Standard Home Insurance May Be Denied

Most mainstream insurers may refuse to cover a home with significant structural issues, such as subsidence, heave, cracks in load-bearing walls, or foundation problems. They typically require a structural survey before providing coverage.

2. Specialist Insurers

If your house has structural issues, you may need to seek coverage from specialist home insurance providers that deal with high-risk properties. These insurers assess risk differently and may offer tailored policies.

3. Higher Premiums & Exclusions

- Higher Costs: Insurers view structurally unsound properties as high risk, leading to higher premiums.

- Exclusions: Some policies might exclude cover for existing structural issues or require you to undertake repairs within a specific timeframe.

4. Subsidence or Previous Claims

If the property has had subsidence issues in the past, insurers may still provide coverage, but they often require a structural engineer’s report. If the home has undergone subsidence repairs with underpinning, an insurer may impose conditions or limitations.

5. Renovation Insurance

If the property is uninhabitable and requires major repairs, you might need a renovation insurance policy instead of standard home insurance. This will protect against damage during construction work.

6. Ways to Improve Insurability

- Get a Structural Engineer’s Report – A professional survey can provide reassurance to insurers.

- Fix Urgent Issues – Some insurers may provide a conditional policy if you commit to fixing problems.

- Look for Specialist Brokers – Brokers who deal with high-risk properties can find the best options.

Can You Sell a House with Structural Issues As-Is?

Yes, selling a house with structural issues “as-is” is possible, but it requires strategic planning and realistic expectations. Homeowners who choose this route must be prepared for lower offers and a smaller pool of buyers, as many mortgage lenders may refuse to finance a property with unresolved structural defects.

Key Considerations When Selling As-Is

- Limited Buyer Pool – Mortgage buyers may struggle to secure financing, making cash buyers and investors the most viable market.

- Lower Offers – Buyers will factor in repair costs and risks, leading to lower offers compared to structurally sound properties.

- Survey and Inspection Issues – A home survey is likely to highlight the defects, which could deter potential buyers or give them leverage for price negotiations.

- Insurance Challenges – Buyers may struggle to get home insurance until repairs are completed, making the property less attractive.

Who Buys Houses with Structural Problems?

- Cash Buyers – Investors or individuals who can purchase without mortgage dependency.

- Property Developers – Those looking to renovate and resell or rent out the property.

- Auction Buyers – Investors looking for below-market-value deals.

- Specialist Buyers – Some firms specialise in purchasing properties with structural defects for redevelopment.

How to Sell a House with Structural Issues As-Is

- Get a Structural Survey – Providing buyers with an independent engineer’s report can add transparency and build trust.

- Be Upfront About Issues – Full disclosure of known defects can help avoid legal issues and attract serious buyers.

- Set a Realistic Price – Price the property based on market conditions, repair estimates, and comparable sales.

- Consider Selling at Auction – Auctions can generate interest from cash buyers willing to take on the repairs.

- Target Cash Buyers – Working with estate agents who specialise in distressed properties can help find the right buyer.

Selling a property with structural issues as-is can be a viable option for those looking for a quick sale, but it is important to manage expectations and ensure legal obligations are met.

Best Ways to Sell a Property with Structural Issues

Selling a property with structural issues requires a strategic approach to attract the right buyers while ensuring transparency and compliance with legal obligations. Here are the best ways to sell a structurally compromised property:

1. Sell Through an Estate Agent Specialising in Problem Properties

- Choose an agent experienced in selling homes with structural issues.

- They can market the property effectively and manage buyer concerns.

- Expect longer selling times if targeting traditional mortgage buyers.

2. Sell to Cash Buyers or Property Investors

- Cash buyers and property developers are often more willing to take on structural issues.

- No need for mortgage approvals, leading to a faster sale.

- Offers may be lower to account for repair costs.

3. Sell at Auction

- Auctions attract investors looking for properties to renovate.

- Sales are often finalised quickly, reducing uncertainty.

- Properties with significant defects may sell below market value.

4. Market the Property Transparently

- Provide full disclosure of structural problems to avoid legal issues.

- Obtain a structural engineer’s report to reassure buyers.

- Offer repair quotes to help buyers understand potential costs.

5. Consider Making Essential Repairs Before Selling

- Fixing minor structural issues can widen the buyer pool.

- Structural repairs can improve mortgage eligibility, increasing value.

- Weigh the cost of repairs against the potential sale price increase.

By choosing the right sales approach and ensuring transparency, sellers can navigate the challenges of selling a structurally compromised property while maximising their chances of a successful transaction.

-

Auction sales streamline the property selling process by eliminating many inefficiencies commonly associated with estate agency transactions. In England and Wales, buyers can legally lower their offer at the last moment or withdraw entirely, whereas in Scotland, regulations differ. This uncertainty is particularly concerning when selling a property with structural issues, as buyers may reconsider at the last minute.

-

One of the primary reasons estate agency sales frequently fall through is the lack of legal commitment from buyers. In contrast, auctions operate under a different framework. Multiple buyers compete for the property, and the sale becomes legally binding upon the exchange of contracts on auction day.

Selling a Leasehold Flat with Structural Issues: Who is Responsible?

Selling a leasehold flat with structural issues can be more complex than selling a freehold property due to shared ownership responsibilities between the leaseholder and the freeholder (landlord). Understanding who is responsible for repairs is crucial before listing the property for sale.

Who is Responsible for Structural Repairs?

- Freeholder’s Responsibility: In most cases, the freeholder (or management company) is responsible for maintaining and repairing external structural elements, including:

- Foundations

- External walls and cladding

- Roof and communal areas

- Load-bearing walls

- Drainage and external pipes

- Leaseholder’s Responsibility: Typically, the leaseholder is responsible for repairs within their own flat, including:

- Internal walls, floors, and ceilings

- Fixtures and fittings

- Plumbing and electrical systems within the flat

- Damage caused by the leaseholder’s negligence

Checking Your Lease Agreement

Since responsibilities vary based on the lease agreement, sellers should carefully review their lease to determine who is liable for repairs. Key sections to check include:

- Repair Obligations Clause – Defines which party is responsible for maintenance and repairs.

- Major Works Clause – Outlines any planned renovations or major structural repairs.

- Service Charges and Reserve Fund Contributions – Indicates if leaseholders must contribute towards major works.

Implications for Selling

- Potential Costs to the Seller: If the building requires urgent structural repairs, leaseholders may be required to contribute to the cost through service charges.

- Mortgage Lender Concerns: Buyers may struggle to secure a mortgage if the property has unresolved structural problems.

- Cladding and Fire Safety Issues: Post-Grenfell regulations require some buildings to undergo cladding remediation. Sellers should check if this affects their property and whether costs have been allocated.

- Legal Disclosures: Leaseholders must disclose known structural issues, pending works, and service charge liabilities in the TA7 Leasehold Information Form when selling.

Steps to Take Before Selling

- Obtain a Management Pack – Includes details on service charges, repairs, and upcoming major works.

- Request a Structural Survey – Can provide clarity on the severity of any issues.

- Communicate with the Freeholder – Clarify responsibilities and check if remedial work is planned or covered by a reserve fund.

- Inform Potential Buyers Early – Being transparent about structural concerns and responsibilities can prevent legal disputes later.

Understanding and preparing for these factors can help leasehold flat owners navigate the sales process more smoothly and avoid potential delays or disputes.

Can I sell a house with structural problems?

Yes, you can sell a house with structural problems in the UK. However, you must be transparent about any issues during the sale process. The structural problems will likely affect the property’s value and may limit your pool of potential buyers to cash buyers or property developers.

Do I legally have to disclose structural issues to potential buyers?

Yes. Under the Consumer Protection from Unfair Trading Regulations 2008, you must disclose any material information that could affect a buyer’s decision. Failing to disclose known structural issues could result in legal action from the buyer after the sale.

How much will structural problems reduce my house value?

Structural problems typically reduce a property’s value by 20-40%, depending on the severity of the issues. Major problems like subsidence can reduce the value by up to 50%. However, each case is unique and should be professionally assessed.

Will buyers be able to get a mortgage on my house with structural problems?

Most mainstream mortgage lenders are reluctant to lend on properties with significant structural issues. This often means your potential buyers will be limited to cash buyers or those who can access specialized renovation mortgages.

Should I fix the structural problems before selling?

This depends on various factors, including the cost of repairs, your financial situation, and market conditions. Sometimes it’s more cost-effective to sell the property as-is at a reduced price rather than investing in expensive repairs, especially if you can’t afford them.

What types of surveys might reveal structural problems during a sale?

Buyers typically commission either a HomeBuyer Report or a Full Building Survey (formerly called a Structural Survey). The Full Building Survey is more comprehensive and will provide detailed information about any structural issues and their implications.

I’m selling a leasehold flat with structural problems – who is responsible for repairs?

In leasehold properties, the responsibility for structural repairs typically lies with the freeholder, but the costs are usually passed to leaseholders through service charges. This can complicate the sale process, as buyers will need to understand both the extent of the problems and their potential financial liability.

Are there specialists who buy properties with structural problems?

Yes, there are property buying companies and developers who specialize in purchasing problematic properties. However, they typically offer significantly below market value, often 50-70% of what the property would be worth in good condition.

How can I make my structurally damaged house more appealing to buyers?

Obtain a structural engineer’s report to provide clarity about the issues and potential remedies. Having quotes for repair work can also help buyers understand the investment needed. Being transparent and having all documentation ready can make your property more attractive to serious buyers.

What documentation should I have ready when selling a house with structural problems?

You should have: a structural engineer’s report detailing the issues, quotes for repair work, any historical documentation about previous repairs or investigations, building insurance information, and if relevant, evidence of any guarantees or warranties for previous work.

Free auction estimate

Request a free valuation and reserve price estimate for your property today. In some cases we may need a few more details about your property before providing a free and no-obligation auction sale estimate.

Contact us for guidance on selling your home by auction. Request a free pre-auction appraisal – we’ll be happy to help.

Guide to selling a house by auction

Explains the stages involved in an auction sale. With information about auction sale costs, timescales and the process for selling at auction.

Carry out improvements before selling?

When selling a property in need of improvement, should I spend money on refurbishment works? Or leave the property as is, and let the new owner take care of improvements?

Poor condition property: Auction VS Estate Agent

The private treaty method of sale isn’t suited to some types of property – it’s inefficient and potentially open to abuse.

Selling a short lease flat

The rules of an auction sale mean that buyers must compete to purchase a property. And the highest bidders offer is legally binding – there is no opportunity for them to reduce their offer.