Selling a condemned property?

- Cost effective

No upfront fee & sell for free options - Quick

Sell your property in as little as 28 days - Secure & reliable

Legally binding sale on auction day - Fair & transparent

Sold to the highest bidder

For your peace of mind we are a member of The Property Ombudsman

Selling by auction is quick and easy. Request a no-obligation auction sale estimate for your house or flat.

- Reliable

- Fast

- Secure

Interested to learn more about the easy and efficient process selling your property by auction?

Talk to our team on 0800 862 0206

Home: Auction Link » Property Types » Selling a Condemned Property

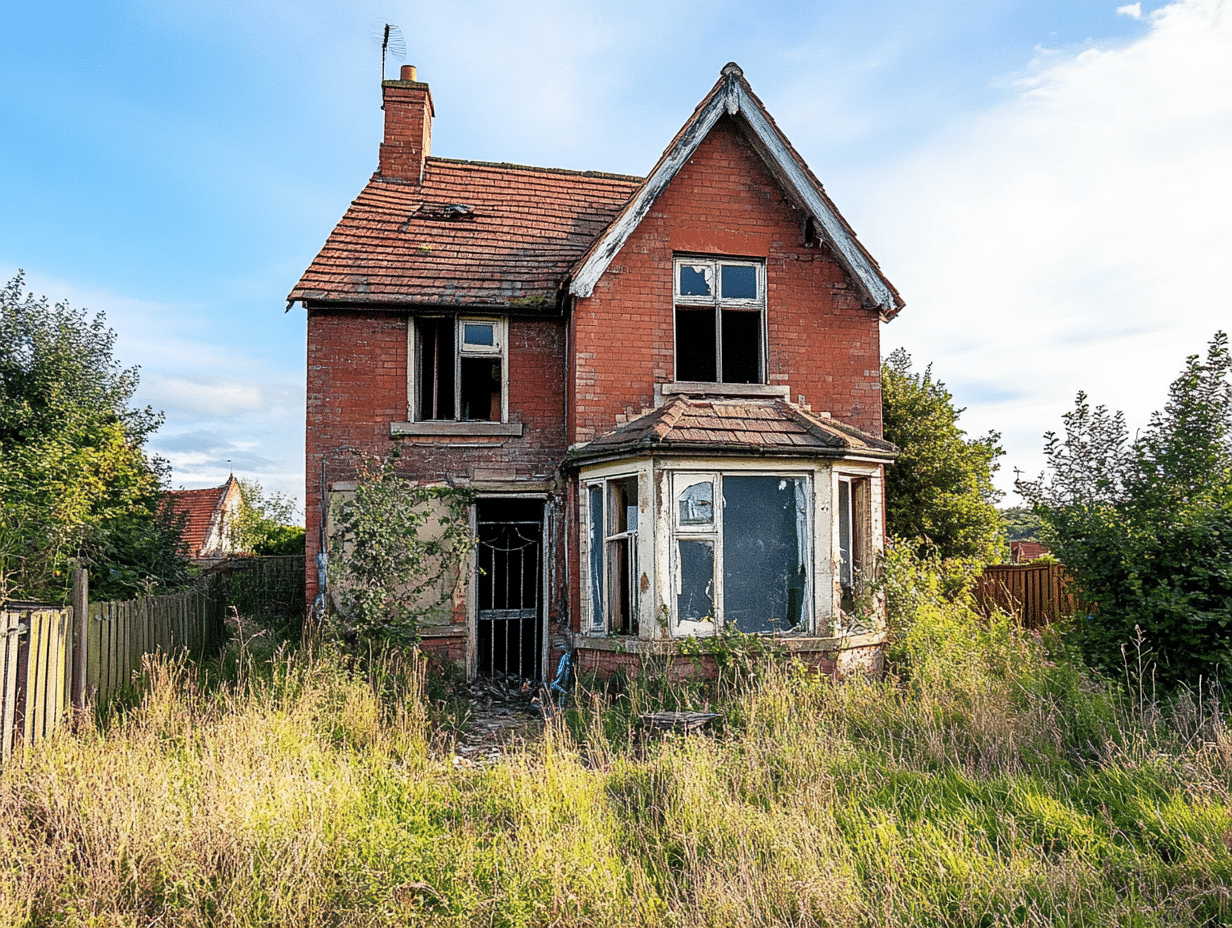

Guide to Selling a Condemned Property in the UK

When your property has received a condemnation order from the local council, you’ll likely want to explore the fastest and most efficient routes to sell. While receiving such news can be distressing, there are several practical solutions available to property owners in this situation.

The complexity of the sale is influenced by factors such as safety hazards, local authority regulations, and market demand. Owners must carefully assess their options, including whether to repair the property, sell it as-is, or explore alternative solutions such as auction sales or negotiations with the council.

Value

Legal

Council Tax

Selling

FAQ’s

If you own a condemned house and are considering selling it, understanding the key issues and regulations will help you navigate the sale efficiently and make informed decisions that maximise your financial return while ensuring legal compliance.

Why sell a condemned house by auction?

- Auction eliminates many of the inefficiencies associated with estate agency sales – in England and Wales buyers can legally reduce their offer at the last moment or withdraw from the sale entirely (laws vary in Scotland).

- This lack of legal commitment from buyers is a key reason why estate agency sales often fall through.

- Auctions follow a different process. Multiple buyers are invited to compete for your property, and the sale becomes legally binding with the exchange of contracts on auction day.

Commitment: Estate Agents vs. Auction

Auction buyers must conduct due diligence and secure financing before placing a bid. All interested buyers are welcome to participate, ensuring no one is turned away.

This process fosters competitive bidding among serious buyers, leading to a legally binding sale on the auction day.

What is a Condemned Property?

A condemned property is a house deemed uninhabitable or unsafe by the local authority due to significant health, safety, or structural concerns. Properties can be condemned for a variety of reasons, including severe disrepair, environmental hazards, or regulatory violations. In some instances, a condemned property may be subject to a legal order requiring urgent repairs or demolition.

Key Reasons a Property May Be Condemned:

- Structural Instability – Severe foundation issues, subsidence, or collapsing walls.

- Fire or Flood Damage – Extensive destruction making the property unsafe for occupation.

- Severe Mould and Damp – Persistent health hazards caused by excessive dampness or lack of ventilation.

- Asbestos or Lead Hazards – Toxic materials that pose significant health risks.

- Utility Disconnections – Lack of essential services such as water, gas, or electricity due to safety violations.

- Illegal Conversions – Unapproved modifications that fail to comply with building regulations.

- Contamination Risks – Properties located on hazardous land or affected by industrial pollution.

- Long-Term Vacancy & Neglect – Prolonged disuse leading to vandalism, squatting, and degradation beyond repair.

Once condemned, a property may require extensive repairs before it can be deemed habitable again. In some cases, the local authority may intervene with enforcement actions to ensure compliance with safety standards.

Jump to section: Frequently Asked Questions

1. Structural Issues

- Subsidence – The property’s foundation is unstable, causing cracks and sinking.

- Severe Roof Damage – Missing tiles or a collapsed roof makes the property unsafe.

- Unsafe Walls or Foundations – Weak structural integrity that risks collapse.

- Fire Damage – A fire-damaged structure may be too dangerous to inhabit.

- Flood or Water Damage – Water damage can weaken walls and foundations, leading to mould.

2. Health and Safety Hazards

- Asbestos – Present in older buildings, requiring specialist removal.

- Black Mould & Damp – Causes respiratory issues and weakens structures.

- Gas & Electrical Faults – Old or unsafe wiring and gas leaks can be hazardous.

- Infestations – Severe rat, termite, or insect infestations.

3. Fire & Environmental Hazards

- Contaminated Land – Properties on industrial or former landfill sites.

- Japanese Knotweed – This invasive plant can damage foundations.

4. Additional Issues

- Vandalism & Squatting – Abandoned properties are often targets for crime.

- Roof & Window Damage – Can expose the interior to further damage.

- Collapsed Floors & Ceilings – Can pose a serious safety risk to occupants and potential buyers.

Determining the value of a condemned house requires a careful assessment of several key factors. Since traditional market valuation methods may not apply, sellers must consider the property’s location, redevelopment potential, and the extent of structural or legal issues affecting it.

Key Factors Affecting Valuation

- Land Value – In many cases, the land itself may hold more value than the structure, especially if the house is beyond repair.

- Extent of Damage – The more severe the structural or environmental damage, the lower the property’s value.

- Redevelopment Potential – If local planning policies allow for redevelopment, the property may attract investors and developers.

- Local Market Conditions – Recent sales of similar properties in the area can help provide an estimate of what buyers may be willing to pay.

- Council Restrictions & Orders – If the property is subject to a Demolition Order or Dangerous Structure Order, this may limit its market appeal and reduce its value.

Is a Structural Survey Worth It?

Yes, obtaining a structural survey can provide a clearer picture of the property’s condition and its potential resale value. A survey, which typically costs between £500-1,500, can help:

- Identify the extent of structural damage – Buyers will want a clear understanding of repair costs.

- Assess whether repairs are financially viable – In some cases, the cost of repairs may outweigh the market value of the property.

- Provide buyers with transparency – Having an official survey report may attract serious investors and reduce negotiation friction.

- Determine insurance implications – Some insurers require a survey to assess the level of risk before offering coverage.

Alternative Methods to Assess Value

- Professional Valuation – A RICS surveyor can provide a valuation based on the current market.

- Auction Guide Prices – Reviewing past auction results for similar properties can provide insight into what buyers are willing to pay.

- Estate Agent Appraisals – Some agents who specialise in distressed properties can offer an estimated sale price based on market demand.

While a condemned house will typically sell for significantly less than a standard property, understanding its value ensures that you position it correctly in the market and attract the right buyers.

The value of a condemned house depends on its location, land value, and redevelopment potential.

Yes, you can sell a condemned house, but you must comply with legal obligations and local authority regulations.

Do You Need Permission to Sell a Condemned House?

In most cases, you do not need direct permission, but if there is a Dangerous Structure Order or Demolition Order, the council may impose conditions before sale.

| Order Type | Description | Relevant Law |

|---|---|---|

| Dangerous Structure Order (DSO) | Issued for buildings that pose immediate danger | Building Act 1984 |

| Demolition Order | Requires demolition due to unsafe conditions | Housing Act 1985 |

| Enforcement Notice | Requires repairs or alterations to meet safety standards | Town and Country Planning Act 1990 |

| Compulsory Purchase Order (CPO) | Allows councils to acquire unfit properties | Housing Act 1985 |

| Empty Dwelling Management Order (EDMO) | Enables councils to take over long-term vacant properties | Housing Act 2004 |

| Hazard Awareness Notice | Warning about serious hazards requiring action | Housing Act 2004 |

What Happens if the Owner Ignores an Order?

Failure to act on a council order can result in serious consequences, both legally and financially. Local authorities have the power to enforce compliance through various means, including financial penalties, forced interventions, and even property seizure.

- Financial Penalties – The property owner may receive fines, which can escalate daily if the issue remains unaddressed. Some councils impose penalties of thousands of pounds for non-compliance.

- Legal Action – Authorities can take the owner to court, potentially leading to further fines or even criminal charges in extreme cases.

- Forced Repairs or Demolition – If the owner fails to act, the council may carry out the necessary work themselves and bill the owner for the costs. If the owner does not pay, a charge can be placed against the property.

- Compulsory Purchase Order (CPO) – In severe cases, the local authority may seize the property through a CPO, forcing the owner to sell it at a price determined by an independent valuation.

- Eviction of Occupants – If the property is occupied despite being condemned, the council may issue an eviction notice for health and safety reasons.

Ignoring an enforcement order can lead to increasing financial burdens and potential loss of the property. Seeking legal advice and cooperating with the local authority can help prevent severe consequences.

Concerns Buyers May Have

Buying a condemned house presents unique risks and challenges, which can deter many potential purchasers. These concerns typically revolve around financial, legal, and practical considerations.

1. High Repair Costs

- Buyers must factor in the cost of structural repairs, which may include addressing subsidence, roof damage, or fire damage.

- Specialist removal of hazards such as asbestos can significantly increase renovation costs.

- Unexpected expenses, such as correcting illegal building work, may arise during the renovation process.

2. Subsidence and Structural Stability

- Foundation issues may require costly underpinning or rebuilding, making the property a high-risk investment.

- Structural surveys can highlight major defects, deterring buyers unwilling to undertake extensive work.

- Properties with subsidence are often unmortgageable, further limiting the buyer pool.

3. Mortgage and Financing Restrictions

- Most high street mortgage lenders refuse to finance condemned properties due to their uninhabitable condition.

- Buyers may need to rely on specialist lenders or cash purchases, making it harder to secure funding.

- High interest rates on bridging loans or development finance may be necessary for refurbishment projects.

4. Insurance Challenges

- Standard home insurance policies often do not cover condemned properties.

- Buyers must seek specialist insurance policies, which come at a higher cost.

- Limited coverage options for flood damage, fire risk, or structural instability can increase financial risk.

5. Environmental and Health Hazards

- Asbestos removal is costly and legally regulated, requiring professional contractors.

- Contaminated land issues from industrial or landfill sites can be expensive to remediate.

- Mould and damp problems can pose serious health risks, making the property less desirable.

6. Legal and Compliance Issues

- The property may be subject to Enforcement Notices, Demolition Orders, or Compulsory Purchase Orders, requiring legal expertise to resolve.

- Planning permission may be required for substantial renovation, which can delay project timelines.

- Compliance with building regulations and safety codes adds to renovation costs and complexity.

7. Potential for Further Deterioration

- If left unmaintained, the property may deteriorate further, increasing restoration costs.

- Unoccupied homes may attract vandals, squatters, and illegal dumping, worsening conditions and requiring additional security measures.

These concerns highlight why condemned houses are typically sold to cash buyers, developers, or investors willing to undertake the associated risks.

Can You Insure a Condemned House?

- Standard insurance is generally not available for condemned properties.

- Specialist insurance brokers offer limited coverage, but at significantly higher premiums.

- Some policies require active renovation plans or security measures to qualify for coverage.

Council tax exemptions may be available for condemned or uninhabitable properties, but the rules vary by local authority. If a property is deemed uninhabitable due to severe structural damage, fire, flooding, or other hazardous conditions, the owner may qualify for an exemption or a reduction in council tax liability.

Types of Exemptions and Discounts

- Class A Exemption (Discontinued in England) – Previously covered unoccupied properties undergoing major repairs or structural alterations. However, some councils may still offer discretionary discounts.

- Class C Exemption (Discontinued in England) – Used to apply to empty properties for up to six months but now varies by local council.

- Severely Damaged or Derelict Properties – If a property is beyond repair and cannot be occupied, it may be removed from council tax valuation entirely. This requires confirmation from the Valuation Office Agency (VOA).

- Uninhabitable Homes Under Development – Some councils offer temporary exemptions or reductions for properties being repaired or redeveloped.

- Long-Term Empty Property Surcharge – If a condemned house remains empty for more than two years, some councils impose a premium, increasing council tax by up to 200%.

How to Apply for an Exemption

- Contact your local council and provide evidence of the property’s condition.

- Arrange for a survey or inspection if required.

- If applicable, apply for removal from the council tax register via the Valuation Office Agency.

Since exemptions vary, it is crucial to check with the local authority to understand eligibility criteria and potential financial relief.

Selling a Condemned House: Key Challenges

Selling a condemned house presents several obstacles that must be carefully managed to ensure a successful transaction. These challenges typically revolve around legal, financial, and logistical aspects, as well as buyer concerns.

1. Legal and Regulatory Issues

- Disclosure Requirements – Under the Property Misdescriptions Act 1991, sellers are legally required to disclose all known defects and hazards.

- Local Authority Orders – If the house is subject to a Demolition Order, Dangerous Structure Order, or Enforcement Notice, special permissions may be required to sell.

- Council Restrictions – Some councils may have specific rules around the sale of condemned properties, especially if they have enforcement actions in place.

- Title and Ownership Issues – If the property has unclear ownership records or unresolved legal disputes, it may complicate the sale process.

2. Financial and Market Challenges

- Limited Buyer Pool – Most traditional buyers avoid condemned properties, meaning you’ll need to target cash buyers, investors, or developers.

- Decreased Market Value – Due to its condition, a condemned house will typically sell at a lower price compared to standard properties.

- Difficulty Securing Financing – Mortgage lenders rarely finance condemned homes, making it difficult to attract buyers who require financing.

- High Cost of Repairs – The cost of bringing the property up to habitable standards may deter buyers, particularly if structural repairs, asbestos removal, or contamination cleanup are required.

3. Buyer Concerns and Perceived Risks

- Structural Safety – Buyers may fear the extent of damage and repair costs.

- Legal Liability – Future buyers may be concerned about compliance with local authority regulations and any pending enforcement actions.

- Insurance Limitations – A condemned house is difficult to insure, which could make reselling or developing the property more challenging.

- Potential for Further Deterioration – If left neglected, the property’s condition may worsen, further reducing its marketability.

4. Selling Strategy Considerations

- Finding the Right Buyer – Marketing the property effectively to developers, auction buyers, or specialist investors is key.

- Auction vs Private Sale – Auctions can lead to competitive bidding, but private sales may provide more control over the selling price and terms.

- Transparency in Sales – Being upfront about the property’s condition and potential legal obligations can help avoid disputes and failed sales.

- Legal and Professional Advice – Consulting property solicitors, surveyors, and estate agents with experience in condemned properties can help navigate the complexities of the sale process.

Despite these challenges, selling a condemned house is possible with careful planning and the right approach.

1. Auction Sale

- Fast and Secure – A legally binding sale upon hammer fall, eliminating uncertainty.

- Investor Audience – Auctions attract buyers familiar with property renovation projects.

- Competitive Bidding – Increased demand from multiple bidders can drive up the final price.

- No Chain Delays – Once sold, contracts are exchanged quickly, ensuring a fast completion.

2. Estate Agency Sale

- Slower Process – Traditional buyers may need extensive surveys and mortgage approvals.

- Risk of Price Reduction – Buyers can negotiate lower prices as more issues arise.

- Limited Buyer Pool – Most mortgage lenders will not finance a condemned property, limiting potential buyers to cash purchasers.

- Lengthy Negotiations – Buyers may request repairs or price reductions after surveys.

3. Selling to a Property Buying Company

- Quick Cash Sale – Often completed in a matter of weeks, bypassing mortgage delays.

- Guaranteed Offer – Property buying companies typically make offers below market value but provide certainty.

- Avoids Repairs and Legal Hassles – The company usually purchases the house in its current state.

- Ideal for Urgent Sales – Suitable if the seller wants to avoid lengthy sales processes and legal complications.

4. Direct Sale to an Investor

- No Estate Agent Fees – Direct sales eliminate commission costs.

- Negotiable Terms – Investors often look for discounted properties but can offer flexible terms.

- Potential for Speed – Investors are often cash buyers, avoiding mortgage-related delays.

- Suitability for Redevelopment – Investors often see condemned properties as an opportunity for development or resale.

Short on time?

If you don’t have the time to read this article in full, we can come back to you with a free auction appraisal, to help you decide if selling by auction is a good option for you. Request a free estimate and we’ll come back to you.

Should You Repair Before Selling?

When deciding whether to repair a condemned house before selling, consider the cost-benefit ratio, the extent of the damage, and your target buyer.

Minor Repairs

- Addressing cosmetic issues such as peeling paint, broken windows, or minor damp problems can make the property more attractive to buyers without significant investment.

- Clearing debris and securing the property can improve its marketability.

- Fixing basic plumbing and electrical issues can make the house slightly more appealing to investors or auction buyers.

Major Repairs

- If the house has severe structural problems, such as subsidence or foundation issues, repairs could be extremely costly and may not increase the property’s value enough to justify the expense.

- Asbestos removal, major roof repairs, or full rewiring could be necessary to make the property habitable but may not be cost-effective.

- In some cases, obtaining planning permission for redevelopment might be a more viable option than extensive repairs.

When to Sell ‘As Is’

- If the cost of repairs outweighs potential returns, selling the property in its current condition may be the best option.

- Many investors and developers prefer to purchase condemned properties at a lower price and handle repairs themselves.

- Selling at auction or to a cash buyer can expedite the process and eliminate the need for costly renovations.

Consulting a Professional

- A structural survey or property valuation can provide insight into whether repairs will significantly increase resale value.

- Consulting an estate agent or auction specialist can help determine if repairs are necessary to attract buyers.

- Speaking with the local council may reveal obligations or grants available for essential repairs.

Alternatives to Selling

Selling a condemned house may not always be the best option, and exploring alternatives can sometimes lead to a better financial outcome or a more practical solution. Here are some alternatives to consider:

1. Renovate and Occupy

- If the cost of repairs is manageable, restoring the home can increase its value significantly.

- Check if local or government grants are available for essential repairs or energy efficiency improvements.

- Addressing major issues such as subsidence, roof repairs, or asbestos removal can make the property habitable again.

2. Negotiate with the Council

- If the property is subject to a Dangerous Structure Order (DSO) or Demolition Order, discuss with the council whether there are any alternatives.

- Some councils offer financial assistance or deferred payment plans for necessary repairs.

- In cases where the council is considering a Compulsory Purchase Order (CPO), negotiating a settlement may be a viable option.

3. Apply for a Change of Use

- If residential restoration is not feasible, converting the land or property into commercial or mixed-use space may be an option.

- Local planning policies may allow for repurposing, such as turning a derelict house into office space, storage, or community housing.

- Consulting with a planning consultant or local authority can provide guidance on the feasibility of a change of use.

4. Lease the Property

- If selling is not an immediate option, leasing the property to a developer or investor may provide short-term income while retaining ownership.

- Some buyers may be interested in a lease-to-own arrangement, reducing the need for an upfront sale.

5. Partner with a Developer

- Collaborating with a property developer could allow for a joint venture where both parties benefit from restoring or rebuilding the property.

- Developers may offer funding in exchange for a share of the future resale profits.

6. Explore Grant and Loan Options

- Some government programs provide funding for housing rehabilitation, particularly for historic or listed properties.

- Specialist lenders may offer renovation loans that can be repaid after the property is restored and sold or rented.

7. Demolish and Rebuild

- If the structure is beyond repair, demolishing the house and rebuilding from scratch may be more cost-effective.

- New-build properties often have higher market values and are more appealing to buyers and mortgage lenders.

Each of these alternatives comes with its own considerations, and seeking professional advice can help determine the best course of action based on financial viability, legal restrictions, and long-term goals.

Read our guide to selling a dilapidated property

Our guide is designed to assist UK homeowners in navigating the sale of an abandoned or dilapidated property.

Read more about selling a dilapidated house by auction.

1. What exactly is a condemned property?

A condemned property is a building that has been officially declared unfit for human habitation by local authorities. This usually occurs when the structure poses serious health or safety risks, such as severe structural issues, dangerous electrical systems, or serious environmental hazards. The property cannot be legally occupied until the issues are resolved and the condemnation order is lifted.

2. Can I legally sell a condemned property in the UK?

Yes, you can legally sell a condemned property in the UK. However, you must be completely transparent about the property’s condemned status and any known issues during the sale process. Failing to disclose this information could result in legal consequences and the sale being voided.

3. How do I determine the value of a condemned property?

The value of a condemned property is typically calculated by:

- Estimating the property’s value if it were in good condition

- Subtracting the estimated cost of necessary repairs and renovations

- Considering the land value independently of the structure

- Factoring in the local property market conditions Professional valuations from surveyors experienced with condemned properties are strongly recommended.

4. Who typically buys condemned properties?

Common buyers include:

- Property developers and renovation specialists

- Investment companies specialising in distressed properties

- Cash buyers and property auction houses

- Experienced DIY enthusiasts looking for a project These buyers usually have the expertise and resources to handle extensive renovations or demolition and rebuilding.

5. What documentation do I need to sell a condemned property?

Essential documentation includes:

- The original condemnation notice from the local authority

- Any structural surveys or engineer reports

- Property title deeds and land registry documents

- Building inspection reports detailing specific violations

- Estimates for repair work (if available)

- Energy Performance Certificate (EPC), even if rated very low

6. How long does it typically take to sell a condemned property?

The sale process can vary significantly but often takes longer than standard property sales. Typical timeframes:

- Through an estate agent: 3-6 months

- At auction: 6-8 weeks from listing to completion

- To a cash buyer: 2-4 weeks The timeline largely depends on the buyer’s intentions and financing arrangements.

7. What are my options for selling a condemned property?

Your main options include:

- Listing with specialist estate agents

- Selling through property auctions

- Working with cash buying companies

- Marketing directly to property developers

- Selling to the local council (in some cases)

- Each option has different advantages in terms of speed, final sale price, and complexity.

8. What legal obligations do I have when selling a condemned property?

Key legal obligations include:

- Full disclosure of the property’s condemned status

- Providing all relevant documentation about the condemnation

- Answering all buyer queries honestly

- Completing a Property Information Form (TA6) accurately

- Maintaining any required insurance until completion

- Complying with any local authority requirements

9. Can I sell a condemned property with a mortgage?

Yes, but it’s more complicated than a standard sale. You’ll need to:

- Obtain permission from your mortgage lender

- Ensure the sale price covers the outstanding mortgage

- Be prepared for limited buyer options, as many lenders won’t provide mortgages for condemned properties

- Consider that the sale might need to be to a cash buyer

10. Should I repair the property before selling?

This decision depends on several factors:

- Your financial situation and available resources

- The extent of required repairs

- Local market conditions

- Potential return on investment In most cases, selling as-is to a specialist buyer is more cost-effective than attempting repairs, unless they are minor and can significantly increase the property’s value.

If you’re unsure about legal obligations, contact your local council or a property solicitor for guidance.

Free auction estimate

Request a free valuation and reserve price estimate for your property today. In some cases we may need a few more details about your property before providing a free and no-obligation auction sale estimate.

Contact us for guidance on selling your home by auction. Request a free pre-auction appraisal – we’ll be happy to help.

Guide to selling a house by auction

Explains the stages involved in an auction sale. With information about auction sale costs, timescales and the process for selling at auction.

Carry out improvements before selling?

When selling a property in need of improvement, should I spend money on refurbishment works? Or leave the property as is, and let the new owner take care of improvements?

Poor condition property: Auction VS Estate Agent

The private treaty method of sale isn’t suited to some types of property – it’s inefficient and potentially open to abuse.

Selling a short lease flat

The rules of an auction sale mean that buyers must compete to purchase a property. And the highest bidders offer is legally binding – there is no opportunity for them to reduce their offer.